http://www.youtube.com/watch?v=ju__z4sdeaE&feature=related

Jack Welch said that to be a great employee and leader, one must first over-deliver the boss' demands. Also, the employee has to look at things from a broad picture, from a different perspective. This is to enable the boss to see things from a different angle, and more importantly, learn something new from the employee.

Second, a boss should find employees with a positive attitude. Nobody wants a black cloud hanging over them. This is very intuitive because a bad apple affects the whole team. Nobody wants to work with an overly negative person.

Third, bosses should look for ambitious people. Employees should have personal goals and a vision for the organisation. However. they should be humble enough not to rub others' off the wrong way. Great employees and future leaders are team players and are often helpful to others. There is constructive ambition and there is destructive ambition. I really like the former and dread the latter. I definitely deslike naked ambition because it almost always drives a person to do wrong things.

I would like to add another advice; I will always prefer intelligent people over sociable people. I am suspicious of people who are very eloquent but are weak in thinking and problem-solving. A great leader surrounds himself with technocrats, not politicians. Technocrats have the best brains to solve problems at hand. They are trained to do the job and recommend the best course of action. I don't need a bunch of "yes-men / women" or people who praise me all the time, although from time to time, I do not mind being complimented. Hence, I generally look first for people with relevant job experience, with proven track records. Second, I will look for people with a Finance degree, a CFA, a Masters in Finance or Economics. Third, I will look for the attitude of the candidate. The candidate must have a positive attitude, a team player, be a problem solver and look at things from a macro perspective. He / she must teach me things, make me smarter.

Hence, it is often difficult to find candidates with the right balance. Some are more form than substance. Others all substance and no form, too raw to hire. Finding the gem in a haystack is always difficult; that candidate who's intelligent, unselfish, mature, business minded. That is a leader in the making.

Postings on investments, soccer and life in general. 分享股票,债券和房地产投资的想法.

Monday 26 December 2011

Thursday 22 December 2011

ECB Takes Out the Back-Door Bazooka! Gold May Recover

This is the year where alternatives and gold work the best. ECB today took out a bazooka worth EUR489 billion to warn speculators not to bet against Eurozone banks. This effectively is a larger amount than US Fed's QE2. It is QE a-la Eurozone!

The comical thing is ECB repeatedly said it cannot directly buy bonds from the peripheral countries. Instead it lent unlimited amounts to Europe's banks. This effectively pumps liquidity into the banking system. Any bank in Europe with any form of collateral with government guarantee can pledge it and borrow at 1%. So a European bank can buy a Spanish bond that pays 1.75% for 1 year and pledge it with ECB, borrow at a rate of 1%. Effectively the bank earns 0.75%.

I was surprised that the US stock markets fell tonight. But I believe it will soon rally at least until January 2012. Under such a scenario, I will do the following asset allocation:

30% Amundi Volatility World USD

20% DB Systematic Alpha SGD Hedged

20% Schroder Gold SGD Hedged

30% First State Global Resources SGD Hedged

My focus will be a lot on alternatives. I am still not very convinced that the stock markets will rally because the EU is in a recession and it is hard to fathom that QE, however big can push stocks up. Back in Sep 2010, stocks rallied after QE2 by the US Fed because economic data turned upwards sharply. I am still watching that space.

Below is a picture of Amundi Volatility World. It is one of the few funds that went up by 5 - 10% after May 2 2011.

CTAs like DB Systematic Alpha didn't do very well, but still it's ability to long and short prevented it to drop sharply in Aug 2011. It's still up 1 - 3% since May 2 2011.

I've been heavily buying Schroder Gold this year. It is uncorrelated with the stock market. I've drawn a comparison between Schroder Gold pink, top line, vs MSCI Asia x Japan (orange line) vs MSCI World (green line). It has outperformed equities. I am quite sure that when the new year comes and institutional investors return from their holidays, gold will resume its uptrend and hit 2000 in 2012.

http://seekingalpha.com/article/315252-the-ecb-may-have-brought-some-glitter-to-gold-for-christmas

The second program drawing investor attention is the ECB’s new LTRO (Long Term Refinancing Operations) program. This is an attempt by the ECB to help banks overcome the 720B Euros' worth of funding due to mature next year (and other large amounts in the ensuing years). It provides for virtually unlimited 3 year loans by the ECB to EU banks who have the collateral to offer up. The ECB is encouraging virtually all banks to take advantage of this program in order to reassure the markets of the stability and the liquidity of the EU banks. The ECB does not reveal the individual names of the participants. The ECB said today, Wed. Dec. 21, 2011, that 523 banks requested a total of 489B Euros ($641B) in funding from the ECB. The US market's reaction to this so far has been negative as it is far more than the median estimate of about 300B Euros. Still I think once the market figures out that the EU bankers would have to be morons not to be availing themselves of this program, the markets should rebound.

We have already seen some positive results from this program. The recent Spanish 3 month T-bill auction on Tuesday paid an average yield of 1.735%. This was down dramatically from the 5.11% in a similar auction a month earlier. Why was the effect so dramatic? Short term T-bills are not in much danger of default. Therefore they are acceptable as collateral. This means banks can buy Spanish T-bills for a yield of 1.735% (currently). Then they can assign the T-bills as collateral for the ECB LTRO 3 year loans. The banks will profit by 0.735% per year on the deal if the ECB’s lending rate is 1% (the current rate). What a cushy deal! Any bank not availing itself of the ECB’s largess is falling far behind the pack.

The Euro/Euro carry trade these banks are effectively entering into is pumping money into the sovereigns' economies. It may be only dramatically lowering the 3-month T-bills right now, but it is having a trickle down effect on the longer dated sovereign bonds. For instance, the Spanish 10 year note yield is at 5.1% today (Wed. Dec. 21, 2011). This is down significantly from its November high of approximately 6.7%, and it is down from its recent secondary peak of approximately 5.8%. 5.1% may still be too expensive for Spain’s economy, but it is a significant improvement. Plus this yield may go further down as the ECB’s strategy may eventually make longer dated T-bills acceptable as collateral. This would have an even larger trickle down effect to longer term notes and bonds. Eventually even notes might be acceptable as collateral. This strategy follows the “patience” theme of the ECB.

Further the banks now have all the extra interest to use to try to shore up their finances. When you are talking about 489B Euros, this is not insignificant. It can provide needed liquidity by itself. If the banks treble borrow, the interest on two parts can pay the interest on the part borrowed for liquidity’s sake (and then some). Of course, the banks are already likely getting interest on whatever non-carry trade securities of their own they are using for collateral. If the ECB lowers its interest rate even further, this program will work more heavily in the banks' favor. This may mean it will result in even lower sovereign T-bill yields (and so bond rates). Since this is desirable, one might expect the ECB to lower interest rates further in upcoming meetings -- more QE.

The recently passed, nearly $1T US Spending Bill is still more liquidity for the markets. Plus it ensures that the US government will be funded for the near future. This is a weight off the markets‘ shoulders. With all of the above events, even with the still present credit crisis, it makes sense that we will see a rally in commodities, especially in commodities such as gold used as a hedge against inflation (liquidity). In fact, gold has already started to rally. It has rallied from its recent low of $1562.50/oz. to its current price of $1628/oz. The gold mining stocks have just started following it upward. If the money managers do indeed want a Christmas rally, the above data and other recent positive data such as the US new home data and recent Initial Claims data should help the money managers engineer a Christmas rally. If you believe this is not only a possible, but a probable outcome, you may want to invest in gold stocks for the near term (and perhaps for the longer term).

All of the major currencies have shown signs of weakness. The universal currency -- gold -- is going to become more important (more valuable) instead of less over the next several years. Many will look at it as an important way to preserve value. We may see it fall further in an EU recession, but it will with strong likelihood pop back up to even higher prices with any recovery.

The comical thing is ECB repeatedly said it cannot directly buy bonds from the peripheral countries. Instead it lent unlimited amounts to Europe's banks. This effectively pumps liquidity into the banking system. Any bank in Europe with any form of collateral with government guarantee can pledge it and borrow at 1%. So a European bank can buy a Spanish bond that pays 1.75% for 1 year and pledge it with ECB, borrow at a rate of 1%. Effectively the bank earns 0.75%.

I was surprised that the US stock markets fell tonight. But I believe it will soon rally at least until January 2012. Under such a scenario, I will do the following asset allocation:

30% Amundi Volatility World USD

20% DB Systematic Alpha SGD Hedged

20% Schroder Gold SGD Hedged

30% First State Global Resources SGD Hedged

My focus will be a lot on alternatives. I am still not very convinced that the stock markets will rally because the EU is in a recession and it is hard to fathom that QE, however big can push stocks up. Back in Sep 2010, stocks rallied after QE2 by the US Fed because economic data turned upwards sharply. I am still watching that space.

Below is a picture of Amundi Volatility World. It is one of the few funds that went up by 5 - 10% after May 2 2011.

CTAs like DB Systematic Alpha didn't do very well, but still it's ability to long and short prevented it to drop sharply in Aug 2011. It's still up 1 - 3% since May 2 2011.

I've been heavily buying Schroder Gold this year. It is uncorrelated with the stock market. I've drawn a comparison between Schroder Gold pink, top line, vs MSCI Asia x Japan (orange line) vs MSCI World (green line). It has outperformed equities. I am quite sure that when the new year comes and institutional investors return from their holidays, gold will resume its uptrend and hit 2000 in 2012.

http://seekingalpha.com/article/315252-the-ecb-may-have-brought-some-glitter-to-gold-for-christmas

"Two of the ECB’s new programs have been drawing investor attention. First the ECB has been saying it will only buy a limit of 20B Euros of sovereign debt per week. However, the committee deciding this limit meets every two weeks to decide the limit going forward, and there has been significant talk of making the limit 20B to 30B Euros per week. With approximately 4.35 weeks in a month, this means the ECB can spend approximately 87B to 130B Euros on sovereign debt a month. Even if you take the 87B Euro figure as the high limit, this is the equivalent of a maximum of approximately $114.5B per month that the ECB can spend on sovereign debt. By comparison, the US Fed’s QE2 program amounted to only approximately $70B/month. The ECB already has the okay to far exceed what the US Fed did. The idea that the ECB is not doing the same kind of QE the US Fed did with its QE2 program is a fallacy. The ECB’s program is potentially several times the size of the US Fed’s program.

The second program drawing investor attention is the ECB’s new LTRO (Long Term Refinancing Operations) program. This is an attempt by the ECB to help banks overcome the 720B Euros' worth of funding due to mature next year (and other large amounts in the ensuing years). It provides for virtually unlimited 3 year loans by the ECB to EU banks who have the collateral to offer up. The ECB is encouraging virtually all banks to take advantage of this program in order to reassure the markets of the stability and the liquidity of the EU banks. The ECB does not reveal the individual names of the participants. The ECB said today, Wed. Dec. 21, 2011, that 523 banks requested a total of 489B Euros ($641B) in funding from the ECB. The US market's reaction to this so far has been negative as it is far more than the median estimate of about 300B Euros. Still I think once the market figures out that the EU bankers would have to be morons not to be availing themselves of this program, the markets should rebound.

We have already seen some positive results from this program. The recent Spanish 3 month T-bill auction on Tuesday paid an average yield of 1.735%. This was down dramatically from the 5.11% in a similar auction a month earlier. Why was the effect so dramatic? Short term T-bills are not in much danger of default. Therefore they are acceptable as collateral. This means banks can buy Spanish T-bills for a yield of 1.735% (currently). Then they can assign the T-bills as collateral for the ECB LTRO 3 year loans. The banks will profit by 0.735% per year on the deal if the ECB’s lending rate is 1% (the current rate). What a cushy deal! Any bank not availing itself of the ECB’s largess is falling far behind the pack.

The Euro/Euro carry trade these banks are effectively entering into is pumping money into the sovereigns' economies. It may be only dramatically lowering the 3-month T-bills right now, but it is having a trickle down effect on the longer dated sovereign bonds. For instance, the Spanish 10 year note yield is at 5.1% today (Wed. Dec. 21, 2011). This is down significantly from its November high of approximately 6.7%, and it is down from its recent secondary peak of approximately 5.8%. 5.1% may still be too expensive for Spain’s economy, but it is a significant improvement. Plus this yield may go further down as the ECB’s strategy may eventually make longer dated T-bills acceptable as collateral. This would have an even larger trickle down effect to longer term notes and bonds. Eventually even notes might be acceptable as collateral. This strategy follows the “patience” theme of the ECB.

Further the banks now have all the extra interest to use to try to shore up their finances. When you are talking about 489B Euros, this is not insignificant. It can provide needed liquidity by itself. If the banks treble borrow, the interest on two parts can pay the interest on the part borrowed for liquidity’s sake (and then some). Of course, the banks are already likely getting interest on whatever non-carry trade securities of their own they are using for collateral. If the ECB lowers its interest rate even further, this program will work more heavily in the banks' favor. This may mean it will result in even lower sovereign T-bill yields (and so bond rates). Since this is desirable, one might expect the ECB to lower interest rates further in upcoming meetings -- more QE.

The recently passed, nearly $1T US Spending Bill is still more liquidity for the markets. Plus it ensures that the US government will be funded for the near future. This is a weight off the markets‘ shoulders. With all of the above events, even with the still present credit crisis, it makes sense that we will see a rally in commodities, especially in commodities such as gold used as a hedge against inflation (liquidity). In fact, gold has already started to rally. It has rallied from its recent low of $1562.50/oz. to its current price of $1628/oz. The gold mining stocks have just started following it upward. If the money managers do indeed want a Christmas rally, the above data and other recent positive data such as the US new home data and recent Initial Claims data should help the money managers engineer a Christmas rally. If you believe this is not only a possible, but a probable outcome, you may want to invest in gold stocks for the near term (and perhaps for the longer term).

All of the major currencies have shown signs of weakness. The universal currency -- gold -- is going to become more important (more valuable) instead of less over the next several years. Many will look at it as an important way to preserve value. We may see it fall further in an EU recession, but it will with strong likelihood pop back up to even higher prices with any recovery.

Sunday 18 December 2011

Bearish Views from GMO and Prechter

GMO's chart below is a very sobering thought. Their basis is profit margins have been over inflated in the last two decades due to interest rates being too low. The recessions in 2000 - 2003 and 2008 did not even bring stock markets down to trend lines. Given that markets tend to over correct, we could witness 8 more years of lower stock prices, i.e. S&P500 trading at March 2009 lows of 667 until 2020. Their advice is to lighten up on equities when stock markets reach new highs or hit resistances.

Robert Prechter is equally bearish and relies entirely on technical analysis. He feels that S&P500 could drop below March 2009 lows and not recover until 2016. That's because we will witness the 3rd wave down from 2012 onwards. the fourth wave could start in 2013 and the fifth wave down could start in late 2013 and end in 2014.

I tend to believe that we will still give investors false hopes until mid 2012 before the real capitulation occurs. Perhaps the doomsday forecast of the end of the world which coincides with the end of the Mayan Calendar could come true! Most OECD countries could still count on QE because inflation rates are still low, at around 2 - 3%. In the UK, it is already at 4%. But when hyperinflation sets in by mid to end 2012, even monetary policy is out. Money printing always benefit only a small group of people. The investors, the entrepreneurs. Most employees will suffer as wages cannot keep up.

From 2H 2012, stocks will rely on the economic data. I believe austerity measures will continue to bite in the EU. They may be in worse shape than they are now. Just think. All this money printing will only devalue USD and EU against Asian currencies. The EU and US will need to import all sorts of goods, from raw materials to manufactured goods. Rising cost of imports will hit the Europeans and Americans. Wages, which comprise 60% of their inflation indices, will fall, but other parts of the indices will rise at a faster rate than the drop in wages. It will push inflation up to around 4 - 6%.

I don't have a good feel about China's economy. It may land harder than in 2008 because this time, the scope for credit expansion on government investment may not be as great. There will be more reliance on private investments this time and it probably cannot cover the gap left by the government. By mid to end 2012, the US' unemployment rate may have dropped to below 8%. Obama may survive the second term by the skin of his teeth. It may be Newt Gringrich of the Republicans if the US economy continues to fall. But sometime around Nov 2012 and beyond, we could see another dip that will take stock markets down to 900. That will be the 3rd wave that Prechter talked about. It could dip below 900 to 800 even.

Don't forget that the demographics of OECD is not favourable. They will have hundreds of millions of baby boomers retiring in the decade of 2010 - 2020. Pension funds will sell stocks desperately and become insolvent. Governments will step in to fund the shortfall. They will print more money until money becomes worthless. But to fund the pension, they will have to cut social welfare, infrastructure and education. This will cause the young, unemployed to riot. If they cut pensions, the old will protest, although they will be less violent because they are weak! It will be such a dreadful decade for the western world.

Growth is only found in emerging Asia. The stock markets could bottom out in 2013, starting with emerging markets equities. My advice is to stay very safe, very diversified. I think Singapore residential property may not even recover until 2014. We may see it fall 20 - 30%. Frightening thought. I haven't even talked about my worst case scenario, which relates to the end of the Mayan Calendar!

Robert Prechter is equally bearish and relies entirely on technical analysis. He feels that S&P500 could drop below March 2009 lows and not recover until 2016. That's because we will witness the 3rd wave down from 2012 onwards. the fourth wave could start in 2013 and the fifth wave down could start in late 2013 and end in 2014.

I tend to believe that we will still give investors false hopes until mid 2012 before the real capitulation occurs. Perhaps the doomsday forecast of the end of the world which coincides with the end of the Mayan Calendar could come true! Most OECD countries could still count on QE because inflation rates are still low, at around 2 - 3%. In the UK, it is already at 4%. But when hyperinflation sets in by mid to end 2012, even monetary policy is out. Money printing always benefit only a small group of people. The investors, the entrepreneurs. Most employees will suffer as wages cannot keep up.

From 2H 2012, stocks will rely on the economic data. I believe austerity measures will continue to bite in the EU. They may be in worse shape than they are now. Just think. All this money printing will only devalue USD and EU against Asian currencies. The EU and US will need to import all sorts of goods, from raw materials to manufactured goods. Rising cost of imports will hit the Europeans and Americans. Wages, which comprise 60% of their inflation indices, will fall, but other parts of the indices will rise at a faster rate than the drop in wages. It will push inflation up to around 4 - 6%.

I don't have a good feel about China's economy. It may land harder than in 2008 because this time, the scope for credit expansion on government investment may not be as great. There will be more reliance on private investments this time and it probably cannot cover the gap left by the government. By mid to end 2012, the US' unemployment rate may have dropped to below 8%. Obama may survive the second term by the skin of his teeth. It may be Newt Gringrich of the Republicans if the US economy continues to fall. But sometime around Nov 2012 and beyond, we could see another dip that will take stock markets down to 900. That will be the 3rd wave that Prechter talked about. It could dip below 900 to 800 even.

Don't forget that the demographics of OECD is not favourable. They will have hundreds of millions of baby boomers retiring in the decade of 2010 - 2020. Pension funds will sell stocks desperately and become insolvent. Governments will step in to fund the shortfall. They will print more money until money becomes worthless. But to fund the pension, they will have to cut social welfare, infrastructure and education. This will cause the young, unemployed to riot. If they cut pensions, the old will protest, although they will be less violent because they are weak! It will be such a dreadful decade for the western world.

Growth is only found in emerging Asia. The stock markets could bottom out in 2013, starting with emerging markets equities. My advice is to stay very safe, very diversified. I think Singapore residential property may not even recover until 2014. We may see it fall 20 - 30%. Frightening thought. I haven't even talked about my worst case scenario, which relates to the end of the Mayan Calendar!

Gold is Near the Bottom. Return Risk Ratio Now Favourable.

Gold tumbled to USD1560oz two days ago. Yesterday, it recovered to USD1596 oz. The last time gold tumbled more than 30% was back in 2008, when the credit crunch hit the world. The start of the QE in the US reversed gold's drop. This week, we witnessed gold falling 19%. I calculated that if it were to replicate 2008's fall, it will reach around USD1470 - 1370 oz. That's another 8 - 15% drop. So buying it at 1560 or 1600 may not be the lowest level. But I will buy in stages because it's attractive. History never repeats. It rhymes. According to Mark Twain.

OECD countries are attempting to inflate their way out of debt. Printing money is the only way to meet the credit crunch and feed the budget deficits. The alternative is war, which thankfully the developed west cannot inflict on us this time. It was possible just 100 years ago, but I suppose the nuclear capabilities of China, India, Pakistan and Russia have balanced the power. We we turn into a deflationary spiral, you can be sure cenral governments will print money to prevent that. Check out the weekly chart of XAUUSD below to see how much gold has risen over the last 4 years. The correction seen now is similar to the one in 2008. This correction may not have run its course yet.

But I recently witnessed a short term reversal. See the daily chart below. A rebound is due and we may see a 7 - 12% rebound before hitting resistance again. I expect 2012 to be the start of another major rally.

Gold could rise until mid 2012 or mid 2013. Thereafter, we could witness hyperinflation and governments being forced to hike interest rates. With austerity measures in place, a deep and long recession may then take place in 2013 or 2014. This means that we are about to face a financial Tsunami never seen before in the last 60 years. Stagflation will mean a synchronised recession across the western world.

I believe though that all is not gloom and doom. Emerging economies will overtake the US and EU in size and will drive growth from 2014 onwards. 2015 could be the start of a tremendous boom in global economy, but with commodity prices at hightened levels.

Hang on tight. Keep lots of dry powder. Invest in CTAs like Winton and Amundi Volatility if you can because not even bonds can protect you again stagflation.

Tuesday 13 December 2011

Gold Fell 3.5%

http://seekingalpha.com/article/313124-precious-metals-pullbacks-in-perspective

Read the above hyperlink. Gold fell to USD1667 oz today! It is on the 200d SMA. It has already fallen 14% from the high of USD1930 oz. I reckon the worst it can get is 1470 oz, which is another 12% downside at most. The return risk ratio looks increasingly attractive and I would buy more at this point.

USDSGD shot up to 1.301 today. AUDUSD to 1.008. Risk aversion is back and it seemed to suck some air out of gold. The fear is that ECB will not print money like the speculators expect.

When gold last fell by 31%, it was during the deflationary times in 2008, before QE came in. But when QE started in Oct 2008, gold started to reflate. This is the likely scenario for 2012 - more QE from the US, Japan, UK and the EU.

Read the above hyperlink. Gold fell to USD1667 oz today! It is on the 200d SMA. It has already fallen 14% from the high of USD1930 oz. I reckon the worst it can get is 1470 oz, which is another 12% downside at most. The return risk ratio looks increasingly attractive and I would buy more at this point.

USDSGD shot up to 1.301 today. AUDUSD to 1.008. Risk aversion is back and it seemed to suck some air out of gold. The fear is that ECB will not print money like the speculators expect.

When gold last fell by 31%, it was during the deflationary times in 2008, before QE came in. But when QE started in Oct 2008, gold started to reflate. This is the likely scenario for 2012 - more QE from the US, Japan, UK and the EU.

Saturday 10 December 2011

Buyers' Stamp Duty. Bravo Singapore Government!

The latest buyers' stamp duties surprised all. Many touted it as the final nail in the coffin of residential properties. Immediately, agents, so-called property commentators who wrote books like "Real Estate Riches", developers and speculators poured scorn over the measures. They all have their agenda.

Agents:

If you think sell-side analysts cannot be trusted and are overly bullish, property agents are the worst of the lot. I've met more than my fair share of agents who have very little knowledge and will tell you anything just to make a sale. With the latest measures, if prices don't drop, transaction volumes surely will.

Developers:

They cried wolf that the government's measures should have targeted foreign developers. They claim that foreign developers bid up land prices and compete against local ones. This is akin to begging the government for protectionism. Why can't foreign developers compete against local developers? If competition increases, standards might increase. What the developers are unhappy about is that it diminishes their already fat margins.

Mind you, property development has made many rich. If they buy land at 900 psf ppr, construction cost is around 250 psf ppr, their breakeven price is around 1150 psf ppr. They sell it at 1300 psf. You might think their margins are very thin, earning something like 150 psf or 13%. But you must know that developers borrow to the hilt. They could borrow as much as 80% or put down as little as 230 psf. So 150 of profit against 230 means an ROE of 65%! Their cash flow is further improved by launching the units way before any construction starts. Often, they collect back their downpayment on the land within several months of the purchase of the land!

Then the other part of the scandal is the "creative" marketing by the developers. The balconies are as much as 10 - 15% of the property, which they did not pay for when they purchased the land. The bay windows, air con vent may account for another 10 - 15% of the property. So altogether, if you think they only sell you at 1300 psf, they could effectively sell you at 1690 psf if you count the "livable" area. This represents a margin of 235%! a profit of 540 psf on an investment of 230! If you ask agents what is the effective, livable space, most wouldn't know. But in developed countries, such information is transparent.

Foreigners

Why do they want to park their money here? I cannot explain the precise reason but one can only guess! If they are allowed to buy any property unchecked, prices will shoot through the roof. What happens when the party ends? Will we end up like Macau or like HK where prices rise and fall like yo-yos? Many fortunes may be lost and found with volatility caused by foreigners. I am afraid that those who lose their fortunes are likely to be the unknowing Singaporeans who live in one home and have their bulk of their wealth locked into one property. Those who profit will be the smartest Singaporeans and foreigners. The rich will get richer, the poor just become beggars.

Why the Policies By Government Were Correct

1. Affordability Index Almost at 2007 Levels

In 2007, mortgages accounted for 38% of Singaporeans' average household income. Then, mortgage rates were 4%. Today, mortgage rates are 1/4 of it, around 1%. Yet affordability is at 35%. What if interest rates start to normalise starting from 2013? We will fall into hard times again. It is this data that tells the government that property prices are a ticking time bomb that will plunge many Singaporeans into hardship as early as 2 years later.

2. Rental Yields Have Fallen to 2007 Levels

As a rule, buy when rental yield rises beyond 4.5%, sell when it falls below 3%. Rental yield is an indication of whether prices have risen beyond economic sense. It is a valuation indicator. Today's rental yield is around 3%, indicating that prices have risen too fast.

3. Increasing Number of Shoeboxes in Outskirts

I seriously cannot believe in the gullibility of Singaporeans who buy shoebox units in outskirts. I believe shoeboxes of between 400 - 700 sq ft is liveable in central regions because people like to live where they work. You can save quite a bit of costs doing that because you hardly drive, you save time by travelling less. I have been living within walking distance from my work place for the last 2.5 years and I love it.

But I have lived in houses as small as 700 sq ft before and I must tell you it's bad for your emotional health. I had to throw away a lot of my furniture when I moved in. The living room was so tiny that I couldn't put my favourite sofa in. When I moved into my present apartment at Clark Quay, which is 1012 sq ft of pure space (NO BALCONY, NO BAY WINDOWS), I felt so relaxed. I could fit in a piano, some gym equipment etc. It felt like home. I told myself that the next house must be over 1200 sq ft.

So I don't understand why anyone would want to pay money to live in a shoebox in Balestier or St Michael when the same amount could get you a nice HDB flat that's 1200 sq ft, fully air conditioned. Do you really need the gym, swimming pool or squash court? I hardly use the pool. I run around my area. It's really over rated living in a condo just for the facilities.

Developers love it because they could increase the psf price by as much as 50% for a shoe box. Gullible Singaporeans buy it because the total quantum is below 1m. So silly. One day the shoeboxes will be empty and people will be dumping it like rats infested plagues.

Curbing Speculation in Commercial Property Next

I strongly urge the government to curb speculation activities in commercial properties next. Rental yields have already fallen from 7-8% in 2009 to 3-4%. It is a bubble. If Singapore does go into a recession, many of the tenants will default. Already, many F&B, retail businesses are laboring under the burden of high rentals. it adds a lot to the cost of doing business.

Already, many of the buyers of commercial properties are in for not just speculative activities, but to store their cash. The government needs to tighten checks on the purpose of such transactions. If commercial property bubble bursts, we it could affect local banks because the LTV given can be up to 80%. Some of our local banks have been the most aggressive in lending to commercial property buyers.

Stock Market Going Down for a Week

Most people are optimistic creatures. Or their jobs require them to be optimistic. Like property agents, most dealers are bullish too. Their clients don't know how to short, or are averse to shorting. So they need to constantly talk up stocks. Look at the chart below of STI. Lower high, lower lows. It's time for another correction.

Credit spreads are at 460 bps. TED spreads around 55bps (2010 was 15 bps). 3month US LIBOR - OIS at 44bps (2010 was 20 bps). Things are not quite right and I believe it will get worse in 2012 before it gets better. The European situation is very long drawn, mind you.

Saturday 3 December 2011

Calm Before Storm in Residential Properties and the World Economy

Lately, a report on Singapore's residential property by Standard Chartered Bank has caught the attention of many. The report said that residential property will probably drop 20 - 40% between 2012 - 2015. It cites issues like over supply which will peak in 2015, slowdown in population growth and rising interest rates from 2013 onwards.

Credit Suisse came out with another report to say that the over supply can easily be absorbed by another influx of immigrants, the government can easily tear down old HDBs to reduce supply.

I do not think highly of the report from Credit Suisse. Singapore's property index has undergone tremendous swings in the last 30 years. There is a tendency for sell-side research to be always positive because the investment banking arm gets deals from the companies they analyse. Don't believe me? Read "Confessions of a Wall Street Analyst" by Dan Reingold. http://www.amazon.com/Confessions-Street-Analyst-Daniel-Reingold/dp/0060747692 It was the same kind of pressure that I faced in my stint as an analyst between 2001 - 04.

Back to Singapore's property index. We now have 5.1 million residents (PR + citizens). If I assume that we increase by 100,000 every year, we will reach 6 million by 2020. Assuming 4 people per household, we can comfortably absorb 25,000 public and private homes completed. Just in 2012, this number will be surpassed. By 2013, completed homes will hit over 30,000 and by 2015 a staggering 50,000. The government can remove the old HDB flats to bring down net supply for sure. But I'm not sure how many they can do every year. Even if they start tearing down old flats, can they afford to do so at a rate of 20,000 per year from 2012 - 2015? I believe what the government wants is to stabilise HDB primary sale prices and bring down the resale prices. Mass market condominiums will definitely follow.

What about foreigners buying Singapore property? They now account for 20% of purchasers. This number could disappear if China's property market drops. Already, analysts are talking about 20 - 40% plunge in property prices in China. The tycoons from China who wish to park their wealth here may just repatriate some money back to China to shore up their flailing businesses. The existence of foreign buying, when uncontained, will increase the price swings.

Then there's the stock market. Will it be bull or bear market in 2012 and 2013? The Singapore residential property correlates somewhat with the stock markets. I said "somewhat" and not "strongly" because there are periods like between 2003 - 2005 where stock markets rallied worldwide while the property remained at the trough. The reason is supply plays a big part.

If we have a recession in the EU, slow growth or a mild recession in the US, a hard landing in China, bringing global GDP down to 0.9% in 2012, will property price fall in 2012? Let's say if stocks rallied from now until beginning 2012, and the US followed up with QE3 in 1Q 2012 and the EU deciding to fund EFSF, would stocks not rally until June 2012? Wouldn't this disconnect with economic realities?

My thoughts are: short term, we are likely to see a stock rally. In 2012, the world will focus on economic data. Any further plunge in PMI in China, ISM in the US will probably trigger another 20% plunge. During this time, value hunters will come in. The Federal Reserve may also help. and stocks may rally 25% from thereon.

So the first half of 2012 could be a volatile one, with the S&P 500 fluctuating between 1300 - 1000, the STI between 2400 - 3100.

For the second half, inflation may start to flare up. EU's inflation could hit 3 - 4% if the ECB yields to pressure. Same as in the US. So QE and money printing option will be out. Will it then crash towards the end of 2012? It could capitulate. Property, which has been stubbornly stable until then, could finally fall 10 - 30%. I feel that S&P500 will at most fall to 800, STI to 2100.

2013 could be a year of recovery. Global GDP could rise to between 1.8 - 2.2%. I feel that property will continue to trend down until mid 2013 before stabilising. Second half of 2013 could be the year stocks start to rally while property remain stagnant.

The question is, oversupply is going to get worse for property while we expect economic recovery in 2014. Which factor will prevail? I sense that we could see a period of stagnation and slow rise in property for 2014 and 2015. We went through 7 good years before 1997 for property. Then we went through 7 very bad years between 1998 - 2004. This is followed by 7 very good years between 2005 - 2011. 2012 - 2018 may not be a very good period for real estate. I may be wrong. But we'll see.

Credit Suisse came out with another report to say that the over supply can easily be absorbed by another influx of immigrants, the government can easily tear down old HDBs to reduce supply.

I do not think highly of the report from Credit Suisse. Singapore's property index has undergone tremendous swings in the last 30 years. There is a tendency for sell-side research to be always positive because the investment banking arm gets deals from the companies they analyse. Don't believe me? Read "Confessions of a Wall Street Analyst" by Dan Reingold. http://www.amazon.com/Confessions-Street-Analyst-Daniel-Reingold/dp/0060747692 It was the same kind of pressure that I faced in my stint as an analyst between 2001 - 04.

Back to Singapore's property index. We now have 5.1 million residents (PR + citizens). If I assume that we increase by 100,000 every year, we will reach 6 million by 2020. Assuming 4 people per household, we can comfortably absorb 25,000 public and private homes completed. Just in 2012, this number will be surpassed. By 2013, completed homes will hit over 30,000 and by 2015 a staggering 50,000. The government can remove the old HDB flats to bring down net supply for sure. But I'm not sure how many they can do every year. Even if they start tearing down old flats, can they afford to do so at a rate of 20,000 per year from 2012 - 2015? I believe what the government wants is to stabilise HDB primary sale prices and bring down the resale prices. Mass market condominiums will definitely follow.

What about foreigners buying Singapore property? They now account for 20% of purchasers. This number could disappear if China's property market drops. Already, analysts are talking about 20 - 40% plunge in property prices in China. The tycoons from China who wish to park their wealth here may just repatriate some money back to China to shore up their flailing businesses. The existence of foreign buying, when uncontained, will increase the price swings.

Then there's the stock market. Will it be bull or bear market in 2012 and 2013? The Singapore residential property correlates somewhat with the stock markets. I said "somewhat" and not "strongly" because there are periods like between 2003 - 2005 where stock markets rallied worldwide while the property remained at the trough. The reason is supply plays a big part.

If we have a recession in the EU, slow growth or a mild recession in the US, a hard landing in China, bringing global GDP down to 0.9% in 2012, will property price fall in 2012? Let's say if stocks rallied from now until beginning 2012, and the US followed up with QE3 in 1Q 2012 and the EU deciding to fund EFSF, would stocks not rally until June 2012? Wouldn't this disconnect with economic realities?

My thoughts are: short term, we are likely to see a stock rally. In 2012, the world will focus on economic data. Any further plunge in PMI in China, ISM in the US will probably trigger another 20% plunge. During this time, value hunters will come in. The Federal Reserve may also help. and stocks may rally 25% from thereon.

So the first half of 2012 could be a volatile one, with the S&P 500 fluctuating between 1300 - 1000, the STI between 2400 - 3100.

For the second half, inflation may start to flare up. EU's inflation could hit 3 - 4% if the ECB yields to pressure. Same as in the US. So QE and money printing option will be out. Will it then crash towards the end of 2012? It could capitulate. Property, which has been stubbornly stable until then, could finally fall 10 - 30%. I feel that S&P500 will at most fall to 800, STI to 2100.

2013 could be a year of recovery. Global GDP could rise to between 1.8 - 2.2%. I feel that property will continue to trend down until mid 2013 before stabilising. Second half of 2013 could be the year stocks start to rally while property remain stagnant.

The question is, oversupply is going to get worse for property while we expect economic recovery in 2014. Which factor will prevail? I sense that we could see a period of stagnation and slow rise in property for 2014 and 2015. We went through 7 good years before 1997 for property. Then we went through 7 very bad years between 1998 - 2004. This is followed by 7 very good years between 2005 - 2011. 2012 - 2018 may not be a very good period for real estate. I may be wrong. But we'll see.

Saturday 26 November 2011

What I Have Been Saying About REIT for Many Years

New Building Guidelines in Singapore

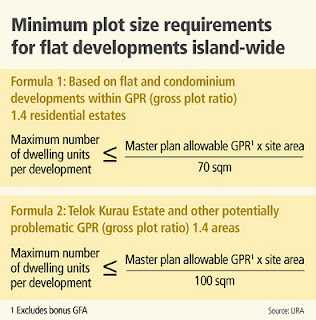

|

This ruling will make it even more difficult to en bloc terraces and semi-detached homes. It will make it compulsory for almost 100% of terrace owners to agree to a collective sale. Imagine there are 10 units of terraces of 1500 sf each that a developer wants to buy. 9 of them agree and one brokeaway. The combined size of 9 units may be 13,500 sf, enough to make a smallish apartment or condo, but since the single unit is less than 10,000 sf, the deal cannot go ahead.

The second ruling warns us against buying any property below 1.4x plot ratio. Developers generally buy properties at "future" prices and then rebuild into much smaller units, selling them at as much as double the price. This ruling will set a minimum size for redeveloped land with a ratio of 1.4. The scam in the last 5 to 6 years has been this: Developers instead of selling a 1000 sf unit for 1000 psf and get 1m in revenue, break the unit into 2 and sell them for 1800 sf, making them cheaper in quantum at 900k per unit. But the developer earns 1.8m. Only silly Singaporeans and foreigners who are keeping their cash here will do that. Perversely, the Singaporeans may not be that dumb because they know that foreigners will buy anything just to keep their cash here. But think of it this way, if there is another Asian crisis, the foreigners may decide to sell these units at 20% below their cost price. If the rental yield is not high, the price could fall very quickly. This is likened to a house of cards.

I am very curious how the Singapore residential sector will pan out over the next 2 to 3 years. I have some hunches but will keep the cards close to my heart.

Published November 25, 2011

| |||

|

New building guidelines take effect

Guidelines will only affect new applications

By MINDY TAN

A MINIMUM plot size requirement of 1,000 square metres and a guide on the maximum number of dwelling units (DUs) for non-landed residential estates were put into effect by the Urban Redevelopment Authority (URA) yesterday.

In addition, for all breakaway proposals from existing landed housing for either flat or landed housing developments within non-safeguarded landed housing areas, the aggregate land area for the left-behind plots must also satisfy the minimum plot size. The impact of this guideline will be felt particularly in the area of en bloc sales for landed housing, noted Tang Woon Ee, partner at Rodyk & Davidson. Citing the example of a breakaway development for a row of terrace houses, she noted that there have been cases of a plot being redeveloped into a block of apartments, with a small, adjoining landed property. 'This will put a stop to this practice, unless the adjoining piece that doesn't want to take part in the collective sale is of that minimum size of 1,000 sq m,' she said. Separately, a guide on the maximum number of DUs for flat and condominium developments within GPR (gross plot ratio) 1.4 residential estates was introduced. The DU guide is also applicable to residential components of mixed-use developments, within GPR 1.4 residential estates, and other low-rise, low-density residential areas. A more stringent formula was developed for areas such as Telok Kurau Estate, which has seen a rapid injection of a large number of units, resulting in significantly higher traffic volumes along the existing narrow local access roads, noted URA. 'If the number of units are being restricted, on average unit sizes will be larger. For developers looking to achieve the same per square foot pricing, you are looking at a higher total quantum that may or may not be supported by the market,' pointed out Ms Tang. The guidelines will only take effect with respect to new applications, added Ms Tang, noting that any formal applications (excluding outline applications) submitted prior to Nov 24 which had been granted provisional permission or will result in provisional permission being granted will be evaluated under the old guidelines. Kovan and Joo Chiat/Jalan Eunos estates were also identified as potentially problematic clusters. URA and the Land Transport Authority are conducting a joint study to determine if more stringent DU guides are required based on the infrastructural capacity of the area. The study is expected to be completed by the third quarter of 2012. | |||

Greek Gods Don't Know Finance

http://www.youtube.com/watch?v=mV98aRJ_IdQ

Wednesday 23 November 2011

Tactical Asset Allocation and Trend Following

I am a huge fan of trend following, because I believe that all asset classes inevitably form a trend, whether up or down. The ability to long or short risk assets is important, as with the ability to control risk and not over leverage.

Revisiting A Quantitative Approach To Tactical Asset Allocation: Good Returns In Reach

by: Tim Fortier November 20,

2011

In May 2006, Mebane Faber published "A Quantitative Approach to Tactical Asset Allocation," (pdf)

which has become a seminal favorite in the area of active portfolio management.

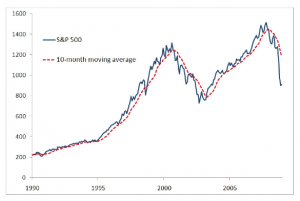

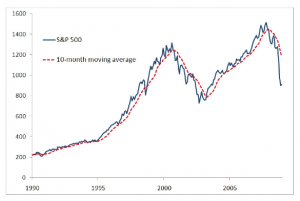

The paper demonstrated how a simple quantitative method of using a 10-month

simple moving average (SMA) could improve the risk-adjusted returns over several

asset classes.

The methodology used in the study was to buy when the monthly price was greater than the 10-month SMA and to sell and move to cash when the price was less than the 10-month SMA.

Click to enlarge

This chart demonstrates the use of the 10-month SMA with the S&P 500. Mr. Faber also applied the same methodology to foreign stocks, REITS, U.S. Government bonds, and commodities.

The conclusions of Mr. Faber's study (see the paper for greater detail) were that risk-adjusted returns were increased almost universally among all asset classes and perhaps most importantly, investors sidestepped protracted market declines. For those who say that there is no value in attempting to time the market, this should prove otherwise.

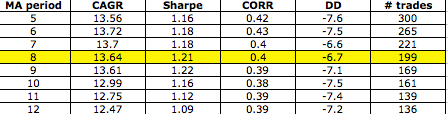

A few ideas I have wondered about were whether the 10-SMA was indeed the best choice for everyday use and what would happen if we introduced a more robust mixture of asset classes.

On the issue of choosing the period to use for the moving average, the challenge is always finding the period of time that balances between minimizing drawdowns and minimizing short term whipsaw. Shorter moving average periods will reduce the distance that prices have to travel before triggering a "sell," thus reducing the size of the decline, but are more subject to reversals in price that trigger a new signal in the opposite direction. This can create a buzz saw effect of eating capital if one is not careful.

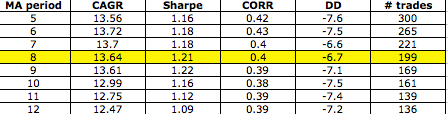

To examine the impact of the moving average time period, I set up a portfolio on ETF Replay with the following four ETFs and one index: SPY, EFA, ICF, IEF, and GTY. The latter is used for the GSCI commodity index as most commodity ETFs have not been around long enough to create a valid study. Using the same rules as in Meb Faber's study, I tested the results using different periods for the SMA. For the time period I started at the beginning of 2003 and ran through 10/31/2011. The results are here:

Based upon these results, the 8-month SMA produced the highest Sharpe ratio with only four additional trades when compared to the traditional 10-period SMA. The impact of the longer moving average period is easy to spot as the longer the period, the larger the actual drawdown.

My rationale for introducing additional asset classes was based upon the simple observation that in recent years, the correlation among most of the major asset classes has approached 1.00, implying that diversification by asset class alone has not provided much direct benefit to risk management for investors.

As I considered the five original asset classes within the original study, the thought was that there would be times when the model would be mostly in cash. While this did serve the purpose of protecting capital, it also meant the model would be limited in what it could earn during such periods.

In fact, from August 2008 through May 2009, the basic tactical model was only 20% invested in the IEF ETF (Intermediate Treasury), with the remaining 80% held in cash.

Since I believe that investors should be indifferent to the direction of the market, I next introduced to the model SH, DOG, and EUM (all inverse ETFs). Additionally, I added ETFs such as GLD, ILF, EWJ, EPP, QQQ, SHY and a few additional international ETFs. When finished, I now had 16 ETFs in my model versus the original 5.

So, the next step was to repeat the exact same process - running a backtest using different SMA periods, during the same time period, and recording the results:

The results were what I had hoped for. The backtested results showed in an increase in the CAGR and the Sharpe ratio while seeing a decrease in the maximum drawdown. While the number of ETFs were increased threefold, the number of trades only increased by double. Nevertheless, the number of trades is such (about 24 per year versus 12 in the basic model) that an investor might consider trading the enhanced model only in qualified accounts such as IRAs.

It seems by the test results that by increasing the number of ETFs, especially by adding a few that can make money in a declining market, the more opportunity the model has to earn additional return. This was displayed in both the increased CAGR and Sharpe ratios when compared to the original model.

This prompted me to perform one more test. This time I would focus on reducing the size of the universe but I would include only those ETFs which had low correlation to each other. The resulting basket contained two inverse ETFs, gold, corporate bonds, short term treasuries, U.S. stocks, foreign stocks, and emerging markets.

Using the 8-month SMA for my test, I obtained the following results:

What this tells me is that when investors are seeking ways to diversify their portfolio, it may be as simple as using the tools they already have available but in a new way. By using a systematic, unemotional, model-based approach, I find that it is not that difficult to keep a portfolio earning the types of returns that most investors require in order to reach their financial goals.

The methodology used in the study was to buy when the monthly price was greater than the 10-month SMA and to sell and move to cash when the price was less than the 10-month SMA.

Click to enlarge

This chart demonstrates the use of the 10-month SMA with the S&P 500. Mr. Faber also applied the same methodology to foreign stocks, REITS, U.S. Government bonds, and commodities.

The conclusions of Mr. Faber's study (see the paper for greater detail) were that risk-adjusted returns were increased almost universally among all asset classes and perhaps most importantly, investors sidestepped protracted market declines. For those who say that there is no value in attempting to time the market, this should prove otherwise.

A few ideas I have wondered about were whether the 10-SMA was indeed the best choice for everyday use and what would happen if we introduced a more robust mixture of asset classes.

On the issue of choosing the period to use for the moving average, the challenge is always finding the period of time that balances between minimizing drawdowns and minimizing short term whipsaw. Shorter moving average periods will reduce the distance that prices have to travel before triggering a "sell," thus reducing the size of the decline, but are more subject to reversals in price that trigger a new signal in the opposite direction. This can create a buzz saw effect of eating capital if one is not careful.

To examine the impact of the moving average time period, I set up a portfolio on ETF Replay with the following four ETFs and one index: SPY, EFA, ICF, IEF, and GTY. The latter is used for the GSCI commodity index as most commodity ETFs have not been around long enough to create a valid study. Using the same rules as in Meb Faber's study, I tested the results using different periods for the SMA. For the time period I started at the beginning of 2003 and ran through 10/31/2011. The results are here:

Based upon these results, the 8-month SMA produced the highest Sharpe ratio with only four additional trades when compared to the traditional 10-period SMA. The impact of the longer moving average period is easy to spot as the longer the period, the larger the actual drawdown.

My rationale for introducing additional asset classes was based upon the simple observation that in recent years, the correlation among most of the major asset classes has approached 1.00, implying that diversification by asset class alone has not provided much direct benefit to risk management for investors.

As I considered the five original asset classes within the original study, the thought was that there would be times when the model would be mostly in cash. While this did serve the purpose of protecting capital, it also meant the model would be limited in what it could earn during such periods.

In fact, from August 2008 through May 2009, the basic tactical model was only 20% invested in the IEF ETF (Intermediate Treasury), with the remaining 80% held in cash.

Since I believe that investors should be indifferent to the direction of the market, I next introduced to the model SH, DOG, and EUM (all inverse ETFs). Additionally, I added ETFs such as GLD, ILF, EWJ, EPP, QQQ, SHY and a few additional international ETFs. When finished, I now had 16 ETFs in my model versus the original 5.

So, the next step was to repeat the exact same process - running a backtest using different SMA periods, during the same time period, and recording the results:

The results were what I had hoped for. The backtested results showed in an increase in the CAGR and the Sharpe ratio while seeing a decrease in the maximum drawdown. While the number of ETFs were increased threefold, the number of trades only increased by double. Nevertheless, the number of trades is such (about 24 per year versus 12 in the basic model) that an investor might consider trading the enhanced model only in qualified accounts such as IRAs.

It seems by the test results that by increasing the number of ETFs, especially by adding a few that can make money in a declining market, the more opportunity the model has to earn additional return. This was displayed in both the increased CAGR and Sharpe ratios when compared to the original model.

This prompted me to perform one more test. This time I would focus on reducing the size of the universe but I would include only those ETFs which had low correlation to each other. The resulting basket contained two inverse ETFs, gold, corporate bonds, short term treasuries, U.S. stocks, foreign stocks, and emerging markets.

Using the 8-month SMA for my test, I obtained the following results:

- CAGR: 10.42% vs. 5.42% for the S&P 500

- Sharpe: 1.12

- S&P 500 correlation: 0.16

- Maximum drawdown: -4.3% vs. -50.8% for the S&P 500

- Number of trades: 84

What this tells me is that when investors are seeking ways to diversify their portfolio, it may be as simple as using the tools they already have available but in a new way. By using a systematic, unemotional, model-based approach, I find that it is not that difficult to keep a portfolio earning the types of returns that most investors require in order to reach their financial goals.

Sunday 20 November 2011

Why It Is Important to Keep Democracy Alive

I've always been chided for airing my views about the importance of checks and balances here. "Why bother to vote? It's already very good here." "How can we betray the government who has done so much for us?" "We have the best people leading us, we don't need a thriving opposition." I agree that we have a world class government, a great leader who brought us from the swarms of third world to become a world class city. We have come a long way. If I had been born in Malaysia, Thailand or China, or even Taiwan or South Korea, I would not have had the same opportunities.

But history counts little towards our efforts to make our nation state even better. The government needs to be more responsive to the needs of the people that are reasonable. Laws must be tweaked to be more just. More checks and balances must be in place to ensure that no one person will become so powerful in future that he is above the law. The push to democratise must continue. Our system will evolve our way, not necessarily mirrored after the west.

I like the Gettysburg Address because it encapsulates the spirit of the Americans that made them the greatest nation for over 150 years. Here it is again.

The Gettysburg Address

Four score and seven years ago our fathers brought forth on this continent, a new nation, conceived in Liberty, and dedicated to the proposition that all men are created equal.

Now we are engaged in a great civil war, testing whether that nation, or any nation so conceived and so dedicated, can long endure. We are met on a great battlefield of that war. We have come to dedicate a portion of that field, as a final resting place for those who here gave their lives that that nation might live. It is altogether fitting and proper that we should do this.

But, in a larger sense, we cannot dedicate—we cannot consecrate—we cannot hallow—this ground. The brave men, living and dead, who struggled here, have consecrated it, far above our poor power to add or detract. The world will little note, nor long remember what we say here, but it can never forget what they did here. It is for us the living, rather, to be dedicated here to the unfinished work which they who fought here have thus far so nobly advanced. It is rather for us to be here dedicated to the great task remaining before us—that from these honored dead we take increased devotion to that cause for which they gave the last full measure of devotion—that we here highly resolve that these dead shall not have died in vain—that this nation, under God, shall have a new birth of freedom— and that government of the people, by the people, for the people, shall not perish from the earth.

But history counts little towards our efforts to make our nation state even better. The government needs to be more responsive to the needs of the people that are reasonable. Laws must be tweaked to be more just. More checks and balances must be in place to ensure that no one person will become so powerful in future that he is above the law. The push to democratise must continue. Our system will evolve our way, not necessarily mirrored after the west.

I like the Gettysburg Address because it encapsulates the spirit of the Americans that made them the greatest nation for over 150 years. Here it is again.

The Gettysburg Address

Four score and seven years ago our fathers brought forth on this continent, a new nation, conceived in Liberty, and dedicated to the proposition that all men are created equal.

Now we are engaged in a great civil war, testing whether that nation, or any nation so conceived and so dedicated, can long endure. We are met on a great battlefield of that war. We have come to dedicate a portion of that field, as a final resting place for those who here gave their lives that that nation might live. It is altogether fitting and proper that we should do this.

But, in a larger sense, we cannot dedicate—we cannot consecrate—we cannot hallow—this ground. The brave men, living and dead, who struggled here, have consecrated it, far above our poor power to add or detract. The world will little note, nor long remember what we say here, but it can never forget what they did here. It is for us the living, rather, to be dedicated here to the unfinished work which they who fought here have thus far so nobly advanced. It is rather for us to be here dedicated to the great task remaining before us—that from these honored dead we take increased devotion to that cause for which they gave the last full measure of devotion—that we here highly resolve that these dead shall not have died in vain—that this nation, under God, shall have a new birth of freedom— and that government of the people, by the people, for the people, shall not perish from the earth.

Seasonality of Stock Markets

Seasonality is a characteristic of a time series in which the data experiences regular and predictable changes which recur every calendar year. Any predictable change or pattern in a time series that recurs or repeats over a one-year period can be said to be seasonal.

This is different from cyclical effects, as seasonal cycles are contained within one calendar year, while cyclical effects (such as boosted sales due to low unemployment rates) can span time periods shorter or longer than one calendar year.

For the Singapore stock market, I have done a seasonality study, showing which months are more bullish and bearish. Contrary to popular belief, October is actually a rather bullish month. Of course,

the diagram below is just the tip of the iceberg for my seasonality studies.

Some key points to note: the best months for being LONG are April, November and December, while the best months for being SHORT are June, August and September.

There are many other patterns (some less obvious) which could have a significant impact on the stock market. Although your trading decisions should not be based solely on these, they can act as a powerful confirming indicator, or help you adjust your position-aggressiveness.

This is different from cyclical effects, as seasonal cycles are contained within one calendar year, while cyclical effects (such as boosted sales due to low unemployment rates) can span time periods shorter or longer than one calendar year.

For the Singapore stock market, I have done a seasonality study, showing which months are more bullish and bearish. Contrary to popular belief, October is actually a rather bullish month. Of course,

the diagram below is just the tip of the iceberg for my seasonality studies.

Some key points to note: the best months for being LONG are April, November and December, while the best months for being SHORT are June, August and September.

There are many other patterns (some less obvious) which could have a significant impact on the stock market. Although your trading decisions should not be based solely on these, they can act as a powerful confirming indicator, or help you adjust your position-aggressiveness.

Thursday 17 November 2011

Watch for Buybacks

There are about 30 exchange-traded funds focused on dividend-paying stocks, but only two focused on stocks that buy back their own shares. While academics might claim that investors should be indifferent between stocks that pay a dividend and those that buy back shares, fund providers know that investors like the allure of dividend funds. But there is good reason to pay attention to firms that reduce their shares outstanding.

Sunday 13 November 2011

Trading Opportunities Avail, But the Bear Prevails

Is the rally that commenced on oct 4, 2011 a bear market rally?

Definition of a Bear Market Rally:

1. General stock market decline of 20% or more, from peak to trough. Note that there will always be false alarms such as in Apr to Aug 2010.

2. Bear market rally is a significant advance of indices 10 - 25% from trough to peak following a bear market decline that fails to break above previous peak and/or sustain over the peak for 10 or more consecutive trading days.

3. If the decline was very steep, e.g. > 25%, and a rally of 33.3% occurs and is sustained for at least 10 consecutive trading days, then it is not a bear market rally. Similarly, a 30% decline will require an advance of 42.9%.

4. After failing to capture and/or sustain the previous peak, stock indices must fall and penetrate the previous trough within a timeframe. This must occur within a time frame not to exceed 2x the amount of time that elapsed between the original peak and original trough. For e.g. the S&P500 peaked on 2 May (1371) and fell to a low on 4 Oct (1075). This took about 5 months to pan out. Hence, by Aug 2012, we should see a break below the previous low of 1075.

Character of Market Action

Definition of a Bear Market Rally:

1. General stock market decline of 20% or more, from peak to trough. Note that there will always be false alarms such as in Apr to Aug 2010.

2. Bear market rally is a significant advance of indices 10 - 25% from trough to peak following a bear market decline that fails to break above previous peak and/or sustain over the peak for 10 or more consecutive trading days.

3. If the decline was very steep, e.g. > 25%, and a rally of 33.3% occurs and is sustained for at least 10 consecutive trading days, then it is not a bear market rally. Similarly, a 30% decline will require an advance of 42.9%.

4. After failing to capture and/or sustain the previous peak, stock indices must fall and penetrate the previous trough within a timeframe. This must occur within a time frame not to exceed 2x the amount of time that elapsed between the original peak and original trough. For e.g. the S&P500 peaked on 2 May (1371) and fell to a low on 4 Oct (1075). This took about 5 months to pan out. Hence, by Aug 2012, we should see a break below the previous low of 1075.

5. A Major Reversal is deemed to have occured (as opposed to a continuation of a bear) if both the bear market decline and the recovery that exceeds the previous peak are "confirmed" by general market movements in which the S&P500, DJI, NASDAQ, Russell 2000 and Wilshire 5,000 ALL participate fully in the criteria set out above.

How to Recognise a Bear Market Rally

Bear market rallies are like bottoms; you can only know for sure that they occured in retrospect. The challenge is to be able to identify the characteristic of a bear market rally as one that is occuring so as to not get lured into one.

The characteristics of a bear market rally are:

1. Fundamentals continue to deteriorate.

In a bear rally, the fundamental forces that led to the initial decline still exists and are deteriorating beyond the level that was seen during the trough. Stocks often rally on relatively insignificant news during a bear market rally. Despite the positive sentiment of late brought on by the ECB buying Italian bonds, the latest economic data from the largest economies shows no signs of improvement.

2. Sharp, relatively low volume advance.

Extremely sharp advances on relatively low volume, driven by purchases by short sellers, put buyers and call sellers that are aggressively executing stop-loss orders. This is indicative of investor behavior driven by emotion rather than carefully considered fundamental and technical criteria. Behavior such as desire amongst traders and investors to "not miss out" on a rally. The rally in the last month was accompanied by smaller volumes than the sudden decline seen in early Aug 2011.

3. Sentiment recovers to extreme highs prior to recovery of prices.

If sentiment indicators show extremely high levels of bullishness and/or extremely low levels of bearishness, this is an indication that the rally may not penetrate the prior highs.

Fundamentals

The stock market decline between May 2 and Oct 4 was premised on fears of a significant global economic slowdown or recession. 2 exogenous factors drove the decline in stock prices. The first factor was a potential economic and financial crisis in Europe. The second factor was a deterioration of fiscal situation in the US beyond tolerable levels due to political dysfunction. Both drivers are still in play.

For the crisis in Europe a catastrophic economic and financial crisis in Europe appears more likely today than it did on Oct 4.

For the US fiscal situation, little has changed. US leaders seem just as far from reaching any sort of acceptable compromise as they were on Oct 4.

GDP and economic activity data may have been better than expected on 4 Oct. However, it is clear that the general trajectory of economic activity and earnings data is significantly down with respect to where expectations were at the peak on May 2.

The threat to the US economy that caused the original decline was never endogenous. the threats were always exogenous ni the form of political inaction on the fiscal front and the crisis in Europe.

Over 30% of SUP sales came from non-US sources and roughly 50% of net earnings. It is important to note that global growth prospects have deteriorated substantially since Oct 4. Even if the US economy manages to tread water, or even exceed current expectations in terms of growth, the severe deterioration abroad can drive down earnings expectations very substantially and serve as the fundamental basis for new equity market lows.

Hence, a sustained recovery above previous highs is not likely. To the contrary, all these factors combined suggest a net deterioration of fundamental factors since Oct 4. Thus new lows are a strong possibility.

Character of Market Action

The advance from the lows on Oct 4 has been extremely sharp. It has been characterised by large "air pockets" and low volume. One measure of vulnerability of the advance has been the swiftness and intensity of pullbacks, as the "air pockets" left behind are filled.

A 50% retracement (1183 on S&P500) of the most recent countertrend high to the trough would offer another strong signal that the recent recovery will ultimately be categorised as a bear market rally. What might change my view regarding the relation between the character of market action and the probability that the current advance is merely a bear market rally?

For example, if the market did a sufficient amount of backfiling and successful testing of key technical levels, the advance would become solidified. Furthermore to the extent that the advance were to become supported by rising volume and broader-based participation, this would suggest a stronger base from which the rally could sustain itself.

Sentiment & Market Psychology

Rallies typically must climb a wall of worry. In particular, after substantial bear market declines, rallies are fueled by a reversal of pessimism and skepticism. If there is no more pessimism and skepticism to reverse, the rally will tend to peter out.

Some analysts have stated that the sentiment indicators that track the level of equity exposure recommended by the newsletter advisors, that the massive increase in bullishness since Oct 4 low has been too great and the decrease in bearishness has been too rapid for the current advance to be sustained. The widely followed bull/bear ratio in the AAII sentiment survey tends to confirm the analysts' view.

Other indicators tell a different story. Implied volatility and other measures of risk aversion indicate a great deal of residual fear and hesitation on the part of investors. Further, even if investor survey sentiment is bullish, this does not mean that asset allocations have had time to adjust to reflect such new-found bullishness.

Thus, despite bullish sentiment data, I believe that investors on aggregate are positioned quite defensively. I believe that they are positioned less defensively than they were on Oct 4 for sure. But I also think that they are still positioned much more defensively than they were on May 2. This suggests that if good news were for whatever reason forthcoming, the stock market could rally significantly - potentially beyond the May 2 highs.

I don't believe that the third characteristic of a bear market rally can be applied to the present case. To the contrary, I believe that this factor suggests that the market has significant upside potential in the short term if news flow is favorable - so much so that a test of the 1,371 is not out of the question on this basis.

What might change my view? Stubborn persistence of bullish sentiment in the midst of pullbacks would be a warning sign. Furthermore, evidence that the equity weightings of institutional investors and/or individuals had equaled or surpassed weightings on May 2 would also trigger a warning signal.

Conclusion

On balance the evidence points to a high probability that the advance since Oct 4 will be viewed in retrospect as a bear market rally. Overall, fundamental trends and fundamental risks have deteriorated significantly beyond what they were on Oct 4. Further, the very sharp and low-volume character of the recovery off the Oct 4 lows has been quite typical of bear market rallies. For these reasons, it is my view that investors should avoid being lured in by this recent advance. It is most likely a bear market rally.

I believe that within the next six months, the stock market will initiate a leg down that will penetrate the recent 1075 low on the S&P500 and ultimately take the index to a region between 950 and 1020.

For this reason, I believe that all but the shortest-term traders should refrain from attempting to play the equity market on the long side through individual stocks or equity market proxies such as SPDR S&P 500 ETF Trust (SPY), DJIA ETF Trust (DIA) or Powershares Nasdaq 100 Index Trust (QQQ). I believe that investors with longer time horizons should raise cash and avoid purchasing or holding otherwise attractive equities such as Apple (AAPL), Microsoft (MSFT) and Pepsi (PEP).

Having said all these, bearish investors and traders should not become overly confident regarding the prospects of a decline. Persistently high levels of risk aversion and generally defensive positioning of investors mean that good news on any of the key fronts - i.e. Europe and/or the US fiscal situation - could fuel substantial rallies.

If investors want to know what would cause my current outlook to change - in either a bullish or bearish direction - they can review the fundamental, technical and psychological criteria outlined in this article and my interpretation of these factors in prior articles. To the extent that any of these factors change, I will change my views accordingly.

Friday 11 November 2011

Am I Too Bearish?

Some people criticise me for being too bearish. I don't think I am. I am "suitably" bearish, or cautiously optimistic. Why?