It's truly setting up to be a September to remember.

Investment markets appear set to break one way or another over the next few weeks. While stocks managed to rally off of Jackson Hole and put together a brief rally to close out August, all bets are off looking out into September, as the calendar is loaded with make or break events that will go a long way in defining how the rest of the year plays out. By the end of the month, stocks could either be poised to rally for the remainder of the year, or they could be cascading off a cliff. Critical events over the next few days and weeks will go a long way in determining the fate of stocks and investment markets.

Through the Labor Day weekend holiday, stocks continued to hold their ground despite recently thrashing about. Despite the sharp decline to kick off the new month, stocks remain well above the recent intraday low of 1101 on the S&P 500 from August 9, at least for now.

click on all charts to enlarge

But signals from a variety of markets indicate that trouble continues to brew under the surface. Starting with the stock market itself, the S&P 500’s Relative Strength Index reached 50 but was unable to make a bullish crossover and instead turned back lower. This is a bearish signal for stocks. The breakout by the Treasury market (IEI, IEF, TLT, TIP) to the upside also suggested that stress is building in the system, as investors continued to flock to safety despite already record low yields.

Gold (GLD) has been another safe haven trade that has been back on over the last seven trading days. Despite many commentators and analysts piling on Gold when it quickly lost steam for two days in late August (which not coincidentally were the same two days when margin requirements were sharply increased for the yellow metal on select exchanges), it has since posted a strong rally over the last seven trading days and appears poised to break out to new all time highs. Silver (SLV) has also responded in an almost identical fashion.

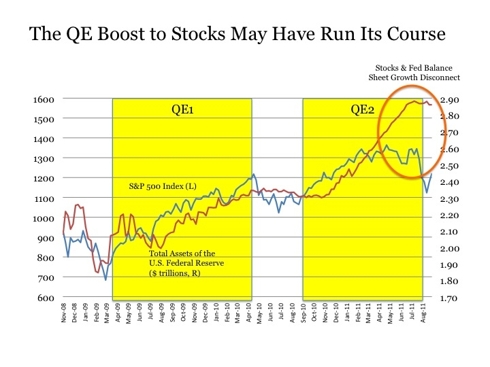

So what is at the core of the market stress? Certainly, the increasingly weakening U.S. economy is playing its part. And the “UNCH” jobs report on Friday did not help. But shouldn’t the consistently bad stream of economic data be playing right into the Tepperesque win-win story for stocks of weakening economy means even more aggressive stimulus from the Fed? Although I have my reservations as to whether QE3 would work in boosting stock prices, neither the weakening U.S. economy nor the lousy jobs report is at the heart of the matter.

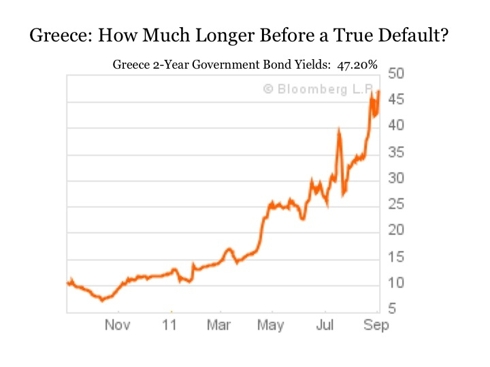

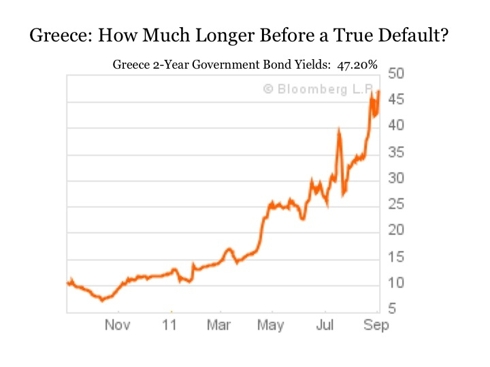

The critical issue for investment markets is Europe. With each passing day, it appears increasingly likely that the situation is going to completely unravel. Greece remains out in front, as it looks like the latest bailout program may collapse amid concerns from the IMF and European leaders that the country is widely missing targets required to secure a second round of rescue funding.

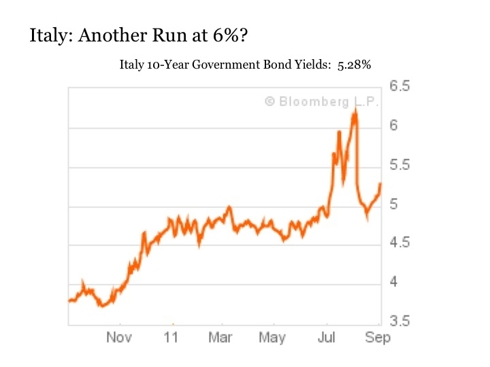

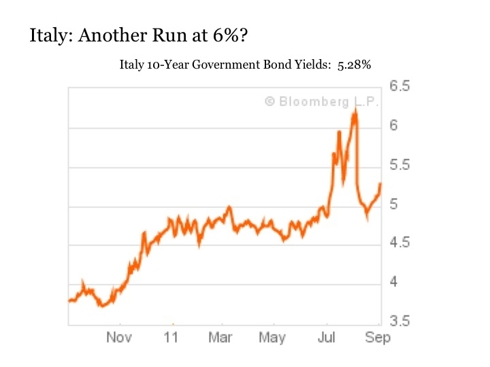

Italy appears to be following close behind. After passing an austerity program in order to receive emergency support from the European Central Bank, the Italian government has been increasingly backtracking on these commitments in recent days. This has sent Italian 10-Year Government Bond yields soaring higher once again toward the critical 6%. On Friday alone, yields jumped 12 basis points to close at the highs for the day at 5.28%.

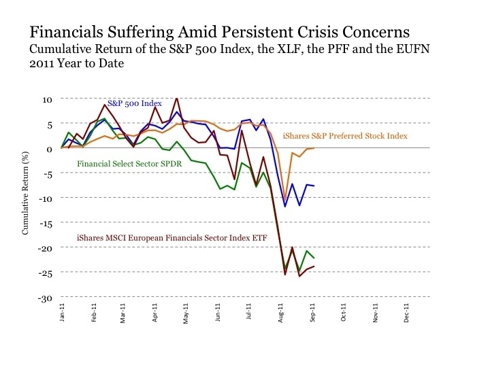

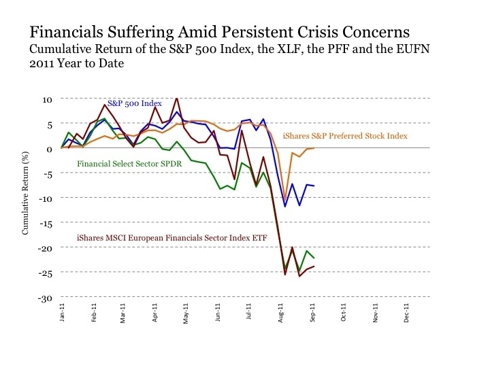

The key risk for investment markets is that a sovereign default in Europe could trigger another global financial crisis similar to what we saw begin to unfold in September 2008. Adding to the worry is the fiscal and monetary arsenal that was available to fight the crisis in 2008 has been largely depleted currently. These worries continue to take their toll on the stock market including the financial sector, which remains down sharply for the year.

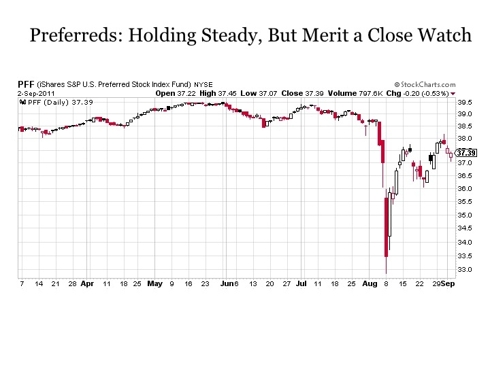

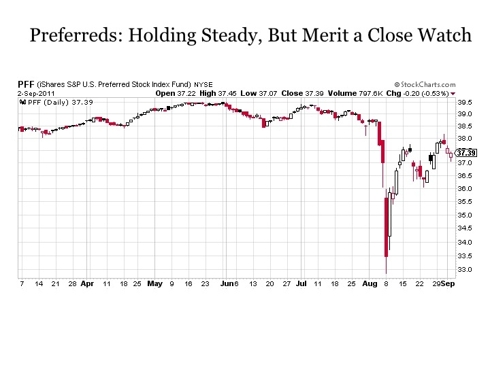

One reassuring signal remains the Preferred Stock market, which continues to trade well above early August lows. However, the recent trade lower over the last three trading days should be watched closely, particularly following the suit announced on Friday by the FHFA against 17 global banks in an attempt to recover losses for Fannie Mae (FNMA.OB) and Freddie Mac (FMCC.OB). If Preferred Stocks begin to tail off to the downside, a severe stock market reaction may soon follow.

Looking out over the month of September, we should soon find answers as to how this is all going to play out. And we may not have to wait for long given the full calendar throughout the month. The following are some of the key events to monitor in the coming weeks:

September 7: The German Federal Constitutional Court is set to rule whether of recent bond purchasing actions by the European Central Bank are in violation of euro zone rules. If the bailouts are determined to be illegal, this has the potential to seal the fate of the monetary union. Thus, this is a most critical news item to watch on Wednesday.

September 8: Two important speeches come on Thursday. The most notable of the two is President Obama’s jobs speech to a Joint Session of Congress. But perhaps just as critical will be Fed Chairman Bernanke’s speech in Minneapolis that day. Not only will this potentially provide a hint at potential policy actions at the upcoming Fed meeting, but it is also his first scheduled appearance following the German vote on September 7. If this vote were to go badly, Bernanke may be much more explicit in his policy language.

September 20-21: The U.S. Federal Reserve is scheduled for a once one day, now two day meeting to discuss its various monetary policy options. Some investors are anticipating some form of stimulus including perhaps a full blown QE3 with more large scale asset purchases. How global events and economic data unfold over the next 16 days will go a long way in determining how the Fed might react if at all. And even if the Fed does react with a full QE3, it may not be the panacea for the stock market this time around that some may be hoping for.

September 23: The German Parliament will vote on the Greek bailout and the expansion of the European Financial Stability Facility. While Germany is the backbone of the euro zone and has been the primary source of funding thus far for at risk economies across the region, the bailouts are becoming increasingly unpopular in the country and political support for any further action is becoming increasingly fragmented. So the vote is far from a sure thing, and this assumes the fiscal situation stays together in Greece long enough to actually get to the vote. In addition, 16 other euro zone nations are scheduled to vote on the bailout program roughly around the same time including Finland, which has demanded collateral from Greece in return for their approval of the rescue plan.

Investment markets have a great deal to monitor and contemplate in the coming weeks. Depending on how events unfold, we could see the final beginning of the end for the euro zone. At the same time, we could see European leaders come together once again to fight on for the monetary union. The stakes are also high in the U.S., as policy makers have the potential to excite markets with new stimulus measures or disappoint with the lack thereof. Interspersed among all of these key events is a steady wave of global economic data that may either show further deterioration toward a double-dip recession or signs of stabilization. And one last wrinkle will be the ongoing travails of selected financial institutions both in the U.S. and in Europe. Several are increasingly wobbling, and any further deterioration may soon lead to a major Lehman like shoe dropping once again in investment markets.

At present, the trend remains toward further deterioration and the risks are biased to the downside. As a result, keeping portfolio hedges such as Gold, Silver and U.S. Treasuries in place is worthwhile to both protect against downside and capture upside opportunity. Stock allocations would also be well served to emphasize the highest quality names in more defensive sectors, as these typically provide dividend income and are likely to experience considerably less volatility relative to the broader market. Lastly, holding an allocation to cash is also worthwhile in seeking to capture opportunities that may present themselves during any potential sharp market sell offs along the way. Stay closely tuned.

Disclosure: I am long GLD, SLV, IEI, IEF, TLT, TIP.

Disclaimer: This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Investment markets appear set to break one way or another over the next few weeks. While stocks managed to rally off of Jackson Hole and put together a brief rally to close out August, all bets are off looking out into September, as the calendar is loaded with make or break events that will go a long way in defining how the rest of the year plays out. By the end of the month, stocks could either be poised to rally for the remainder of the year, or they could be cascading off a cliff. Critical events over the next few days and weeks will go a long way in determining the fate of stocks and investment markets.

Through the Labor Day weekend holiday, stocks continued to hold their ground despite recently thrashing about. Despite the sharp decline to kick off the new month, stocks remain well above the recent intraday low of 1101 on the S&P 500 from August 9, at least for now.

click on all charts to enlarge

But signals from a variety of markets indicate that trouble continues to brew under the surface. Starting with the stock market itself, the S&P 500’s Relative Strength Index reached 50 but was unable to make a bullish crossover and instead turned back lower. This is a bearish signal for stocks. The breakout by the Treasury market (IEI, IEF, TLT, TIP) to the upside also suggested that stress is building in the system, as investors continued to flock to safety despite already record low yields.

Gold (GLD) has been another safe haven trade that has been back on over the last seven trading days. Despite many commentators and analysts piling on Gold when it quickly lost steam for two days in late August (which not coincidentally were the same two days when margin requirements were sharply increased for the yellow metal on select exchanges), it has since posted a strong rally over the last seven trading days and appears poised to break out to new all time highs. Silver (SLV) has also responded in an almost identical fashion.

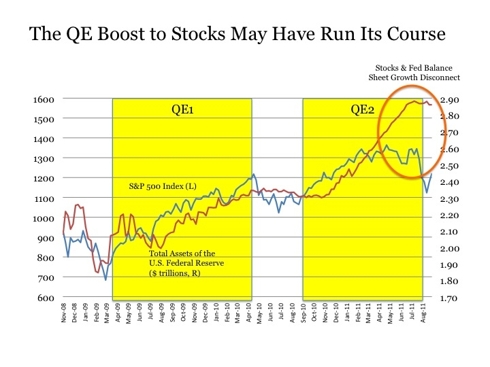

So what is at the core of the market stress? Certainly, the increasingly weakening U.S. economy is playing its part. And the “UNCH” jobs report on Friday did not help. But shouldn’t the consistently bad stream of economic data be playing right into the Tepperesque win-win story for stocks of weakening economy means even more aggressive stimulus from the Fed? Although I have my reservations as to whether QE3 would work in boosting stock prices, neither the weakening U.S. economy nor the lousy jobs report is at the heart of the matter.

The critical issue for investment markets is Europe. With each passing day, it appears increasingly likely that the situation is going to completely unravel. Greece remains out in front, as it looks like the latest bailout program may collapse amid concerns from the IMF and European leaders that the country is widely missing targets required to secure a second round of rescue funding.

Italy appears to be following close behind. After passing an austerity program in order to receive emergency support from the European Central Bank, the Italian government has been increasingly backtracking on these commitments in recent days. This has sent Italian 10-Year Government Bond yields soaring higher once again toward the critical 6%. On Friday alone, yields jumped 12 basis points to close at the highs for the day at 5.28%.

The key risk for investment markets is that a sovereign default in Europe could trigger another global financial crisis similar to what we saw begin to unfold in September 2008. Adding to the worry is the fiscal and monetary arsenal that was available to fight the crisis in 2008 has been largely depleted currently. These worries continue to take their toll on the stock market including the financial sector, which remains down sharply for the year.

One reassuring signal remains the Preferred Stock market, which continues to trade well above early August lows. However, the recent trade lower over the last three trading days should be watched closely, particularly following the suit announced on Friday by the FHFA against 17 global banks in an attempt to recover losses for Fannie Mae (FNMA.OB) and Freddie Mac (FMCC.OB). If Preferred Stocks begin to tail off to the downside, a severe stock market reaction may soon follow.

Looking out over the month of September, we should soon find answers as to how this is all going to play out. And we may not have to wait for long given the full calendar throughout the month. The following are some of the key events to monitor in the coming weeks:

September 7: The German Federal Constitutional Court is set to rule whether of recent bond purchasing actions by the European Central Bank are in violation of euro zone rules. If the bailouts are determined to be illegal, this has the potential to seal the fate of the monetary union. Thus, this is a most critical news item to watch on Wednesday.

September 8: Two important speeches come on Thursday. The most notable of the two is President Obama’s jobs speech to a Joint Session of Congress. But perhaps just as critical will be Fed Chairman Bernanke’s speech in Minneapolis that day. Not only will this potentially provide a hint at potential policy actions at the upcoming Fed meeting, but it is also his first scheduled appearance following the German vote on September 7. If this vote were to go badly, Bernanke may be much more explicit in his policy language.

September 20-21: The U.S. Federal Reserve is scheduled for a once one day, now two day meeting to discuss its various monetary policy options. Some investors are anticipating some form of stimulus including perhaps a full blown QE3 with more large scale asset purchases. How global events and economic data unfold over the next 16 days will go a long way in determining how the Fed might react if at all. And even if the Fed does react with a full QE3, it may not be the panacea for the stock market this time around that some may be hoping for.

September 23: The German Parliament will vote on the Greek bailout and the expansion of the European Financial Stability Facility. While Germany is the backbone of the euro zone and has been the primary source of funding thus far for at risk economies across the region, the bailouts are becoming increasingly unpopular in the country and political support for any further action is becoming increasingly fragmented. So the vote is far from a sure thing, and this assumes the fiscal situation stays together in Greece long enough to actually get to the vote. In addition, 16 other euro zone nations are scheduled to vote on the bailout program roughly around the same time including Finland, which has demanded collateral from Greece in return for their approval of the rescue plan.

Investment markets have a great deal to monitor and contemplate in the coming weeks. Depending on how events unfold, we could see the final beginning of the end for the euro zone. At the same time, we could see European leaders come together once again to fight on for the monetary union. The stakes are also high in the U.S., as policy makers have the potential to excite markets with new stimulus measures or disappoint with the lack thereof. Interspersed among all of these key events is a steady wave of global economic data that may either show further deterioration toward a double-dip recession or signs of stabilization. And one last wrinkle will be the ongoing travails of selected financial institutions both in the U.S. and in Europe. Several are increasingly wobbling, and any further deterioration may soon lead to a major Lehman like shoe dropping once again in investment markets.

At present, the trend remains toward further deterioration and the risks are biased to the downside. As a result, keeping portfolio hedges such as Gold, Silver and U.S. Treasuries in place is worthwhile to both protect against downside and capture upside opportunity. Stock allocations would also be well served to emphasize the highest quality names in more defensive sectors, as these typically provide dividend income and are likely to experience considerably less volatility relative to the broader market. Lastly, holding an allocation to cash is also worthwhile in seeking to capture opportunities that may present themselves during any potential sharp market sell offs along the way. Stay closely tuned.

Disclosure: I am long GLD, SLV, IEI, IEF, TLT, TIP.

Disclaimer: This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.