2011 Market Mirroring 2010: Expect Further Drop When QE2 Ends

June 21, 2011 |

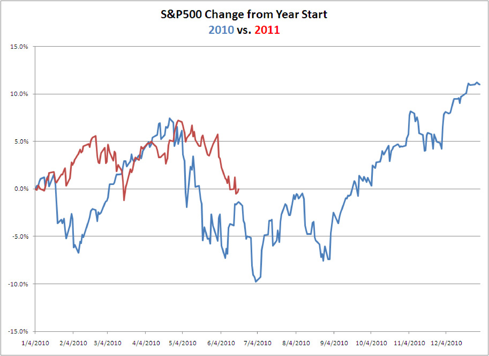

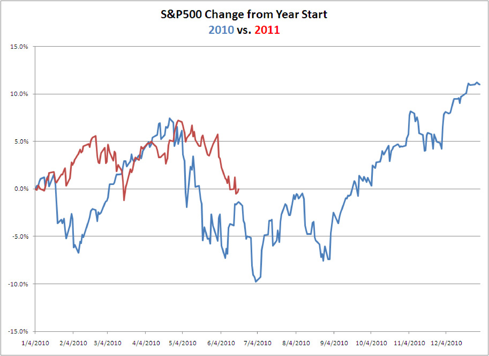

As of Friday, June 17, 2011, the S&P 500 was exactly flat for the year while it was down 1.5% on the same date in 2010. Looking at performance for the year in the chart below, the overall movement in the last few months is scarily similar (click to enlarge image):

Weighting down the market is the fact that earnings are flattening out today - while they were growing strongly in 2010 - and that QE2 is ending on June 30. Plus the Greek default crisis plus a slowing economy plus ... I'm sure you can add something.

With nothing positive on the horizon, a further decline of at least 10 % to around 1100 appears possible between July and September. QE3 will probably be announced (or hinted at as it was in 2010) as the market approaches a 20% "bear market" decline.

Disclosure: I have no positions in any stocks mentioned, but may initiate a short position in SPY over the next 72 hours.

Weighting down the market is the fact that earnings are flattening out today - while they were growing strongly in 2010 - and that QE2 is ending on June 30. Plus the Greek default crisis plus a slowing economy plus ... I'm sure you can add something.

With nothing positive on the horizon, a further decline of at least 10 % to around 1100 appears possible between July and September. QE3 will probably be announced (or hinted at as it was in 2010) as the market approaches a 20% "bear market" decline.

Disclosure: I have no positions in any stocks mentioned, but may initiate a short position in SPY over the next 72 hours.