1987, the fall of 36% occured within 3 trading days. It took about 3 years to recover the losses. Hence my theory is that stock markets fall more than 3 times faster than it rises. Even I would find it difficult to cut with minimal losses. I would have sold my stocks at around 20% down at best.

2000 - 2003:

The tech bubble took a long time to unfold. From the peak some time in Jan 2000, the Dow and S&P500 fell by around Apr 2003. It took about 3.5 years to unfold with lots of rebound. In fact by Aug 2001, the Dow fell from 12000 to 10500 and you still would not be sure if we are in a bear. However, the 150 D EMA of 10800 showed the Dow fluctuating between 12000 to 10500 for 1.75 years, around 12 - 13% trading range, alternating between bull and bear territories for sometime. This should be another warning to investors that stocks are in trouble. When 9/11 came, it was another 20% down. Another warning sign is the 150 D EMA dipping downwards. Never buy when this happens.

2008:

The last 4 years has been the age of financial crisis. Oct 2007 was the peak of the S&P500. 7 months later, there was a huge rebound to keep the downside from the peak at 10%. However, it was the last chance to exit. After May 2008, markets continued to trend lower before they capitulate in Oct 2008.

Conclusion:

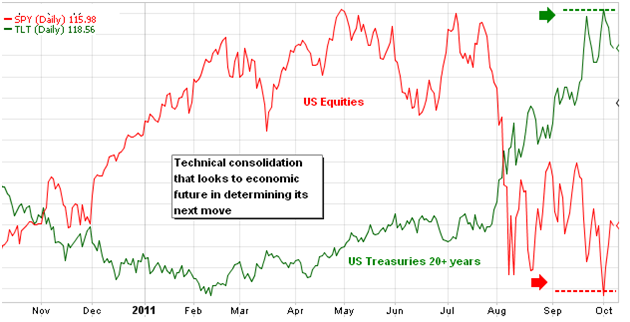

My take is that we usually have better exit points for equities up to 7 to 8 months after the highest point. But if those chances are not taken, we could suffer huge falls. Our experience in 1987 showed that it could not be avoided because the crash took place over 3 days. But the crashes in 2000, 2008 and now will probably give us opportunities to exit with around 10% losses.

Get out early, get out on rebounds. If unsure, stay sidelined and do bonds, do CTAs.