Postings on investments, soccer and life in general. 分享股票,债券和房地产投资的想法.

Monday, 30 August 2010

Singapore Property Buyer August 2010 Outlook

http://www.propertybuyer.com.sg/articles/singapore-property-investor-buyer/singapore-property-buyer-august-2010-outlook/

Singapore Property Buyer August 2010 outlook

The market has risen from dramatically from June 2009. Within 3 months from June 2009 to Sep 2009, the market went crazy. Between Sep 2009 to July 2010, Singapore property prices continued to move up.

By the 1Q, 2010, landed property in Singapore has reached 175.0, Non landed property has reached 174.5. (URA price index 1st Quarter 2010)

Rising by 8.3% for landed property between 4Q, 2009 and 1Q, 2010, condominiums rose another 5.7% between 4Q, 2009 and 1Q, 2010.

Source: URA

As we write, prices of properties such as Aspen heights have hit $1600 psf, Leonie Studios hit $1600 to 1700 psf, 76 Shenton reached $2100 psf, Waterfall Garden $1730 psf, Cyan at $2400 psf, Ardmore Park and Ardmore II have reached $2500 to $3000 psf.

Even mass market condominiums are approaching or have breached $1000 psf. Many mass market developments such as The Waterina are going for $900 to $1000 psf. Even the Atrium Residences within Geylang is going for $700 to $800 psf.

Effects of Share market on sentiments

The share market has also recovered to about 3000 points on the Straits times index.

Source: Yahoo Finance

The share market has also stagnated since late last year. The share market usually leads the property market by 3 to 6 months. However it would be quite hard to predict property prices based on the share market as this time round, this time round, the covariance may be less (but to be verified). The property market's rise is due rather to the under-supply of HDB flats which supports price rise.

Throughout this recession in 2008 and 2009, Singapore expatriates are the least affected in terms of job losses compared to locals (Ministry of manpower). And there has been a quick return of expatriates through job recovery in Singapore. This supports rental as well as mid to high end property market.

Many studies have found a positive correlation between the share market prices and property prices. As this share market wealth cannot fully account for raising funds for down-payment of properties or raise long term affordability in terms of earning capacity, therefore we conclude that it is sentiment driven as many analyst have concurred before us.

CREDIT, LIQUIDITY, MONETARY AUTHORITY AND SINGAPORE BANK’S INTEREST RATES

Singapore's market has no lack of credit given the low bank interest rate environment, so what supports the prices and transaction volumes are in many cases consumer confidence.

Therefore when there are positive press spins, news reviews and or awareness of certain property launches or economic projections which accentuates the possibilities (regardless of whether it is well grounded in facts or not), the property awareness and demand appears.

Recently, the deputy Managing Director of Monetary Authority of Singapore Mr. Ong Chong Tee has come out and clarified that the Sibor’s dropped in interest rates is no cause of alarm as this is due to a change in MAS’ Singapore currency stance going from Neutral to Appreciation against our major trading partners. As a result of this change in stance, smart money flowed into Singapore in anticipation of currency appreciation of the Singapore dollar.

The previous time in 2008 when interest rates suddenly fell, it was due to a looming recession. We at Property Buyer Singapore Mortgage Consultants are satisfied with the explanation and are happy that there was an explanation from Mr. Ong of MAS.

However we are still unclear why Monetary Authority of Singapore wants to change Singapore’s currency stance to “Appreciation”. Does MAS foresee food and commodities inflation?

Does MAS foresee turbulence in the surrounding countries and are instead using monetary policy as a means to maintain liquidity in the Singapore banking system?

Risks for Singapore Property buyers and investors

The risk to Singapore property buyer is becoming elevated. Based on URA's price index, the prices now are even higher than the previous peak in 1996. This means that, there is no more guidance going forward as we moved into uncharted territory. Where the market will go is fairly uncertain. The market will not only behave in accordance with supply and demand, but will also take it's cue from the local domestic economy as well as what is happening in the world, such as the from the USA, China and Europe.

Mass Market Condominium Prices and outlook

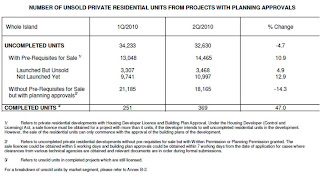

The mass property condominium market will be guided by supply and demand of HDB housing. This is expected to continue it's ascent, although at a slower pace. Huge supply shortage by HDB coupled by a massive immigration policy has created a huge problem of rising property prices right from the base level of HDB. However, do note that there are still some 61,000 units of private residential supply in the pipeline up till 2015 and more than 30,000 of unsold units out of that 61,000 units.

Source: URA

High End Luxury Market Property outlook

The high end Luxury Market, it is more often guided by prices of the best properties in each of the advanced economies.

This market is often defined by superlatives such as, the best, the tallest, the best view, the nearest, the most exclusive and etc.

As the Singapore property market has reached a peak that is never before reached since 1996, the high end luxury market can be a bit lost for direction. This can cause nervousness when the market is not exuberant.

We feel that the government fears that the super high end luxury market will soften. The government (through the state media) has always taken pains to point out that despite the super high Per square feet prices (psf) reaching ever new heights, it is still cheap compared to Hong Kong, Tokyo, London, New York and Paris, other global cities.

And high end luxury properties in Singapore has seen keen interests from Singapore expatriates as well as super high net worth foreigners parking their money here or buying another home in this part of the world as part of their travel itinerary.

The areas categorized by high end luxury properties are: -

Ardmore park, Grange road, Leonie Hill, Oxley Road, Patterson road, Botanical garden area, st. Martin, Balmoral road, Marina Bay, Sentosa Cove and etc.

Of these, Marina Bay and Sentosa cove are new entrants to the luxury market, the rest are the traditional District 9, 10 and 11 areas. There are more high end luxury properties that may be launched in the coastal areas such as Keppel road, Shenton Way. All are masquerading as a potential high end luxury property candidate, but not all will have the attributes befitting that of High end luxury properties. Therefore buyers need to be careful to identify the genuine High End luxury properties.

Super high end Luxury properties have been characterized by high price volatility

The difference could be between paying $4000 psf versus $2500 psf. For those people who are adequately rich with $5 to $10 million in net assets, this could be the investment that hurt their net worth if they buy at the wrong time. For those with $20 to $100million, there is substantial holding power, therefore whether they take it as an investment or consumption, it doesn't really matter.

This segment of rich high net worth individuals come and go in droves depending on policies of their home countries such as tax treatment as well as economic cycles. The price premium given for frills and property features may be severely compressed during bad economic cycles.

Super High End Luxury Property rise create head-room for the Mid end luxury market

Mid end luxury markets are defined as those in outer central region. Typically those in the fringe of District 9, 10 or 11. These properties are currently in the price range of $1100 to $1500 psf. With the price ceiling of properties such as Leonie Studio at $1700 to $1800, 76 Shenton at $1800 to $2000 psf range, it will be hard for the mid end properties to rise above $1600 psf. Therefore, the top of their pricing range would likely be, $1600 psf while the median and mean prices are likely to gather closer together at $1300 to $1400 psf as the mass market condominiums are already closing in at $1000 to $1100 psf for 99 years properties in traditionally non prime areas.

Singapore Property Owner and Buyer's Holding Power

Employment figures are firm and is unlikely to throw a spanner in the works as there is only 2.2% headline unemployment as at Mar 2010 (source: Ministry of manpower). There is still a shortage in HDB supply. While land is being released for sale by the government, the physical property shortage is not immediately eased.

Therefore as long as property buyers are going in with reasonable prices and not over-bid, then the likelihood of being caught off guard in a sudden downward spiral of prices is limited. This would mean that property buyers would be better off to bid within the median of valuations.

The prices for properties in Singapore (in general) should still hold firm. However this may not hold true for certain high price volatility developments or projects where large swings are possible.

HIGH END PROPERTY MARKET Versus Mass Market

The high end market should still hold firm, perhaps with potential to appreciate. Those properties very near to the high end market should trend upwards if such high end market firms up.

Properties with attributes that matches the best of it’s kind worldwide will have a price benchmark comparable to the best properties in internationally well known locations. Such amenities may include very exclusive attributes such as Yatch berthing, Helipad, panic room, sea view, special butler service, near to resorts, town and financial centres, centres of activities and entertainment, port access, private lift lobbies, super high ceilings, golf, infinity pools, security service, near to expat schools, and special immigration and residential rights in some countries or superlatives such as highest, tallest, most luxurious, or certain design attributes that puts them amongst the very best worldwide.

When high end market moves upwards, this creates increased head-room for the properties one grade below the high end market to move upwards.

The rises may then ripple out throughout the country. If the rises at the high end market are highly selective, such positive price rises led by high end market may not fully ripple throughout the country. This will widen the price gap between the mass market and the high end luxury market.

Mass market and High end markets are properties belonging to different worlds. The mass market is characterized more by affordability while the high end market can defy gravity to some extent. Therefore we can say mass market properties are sensitive to affordability and general income conditions.

Source: Singapore Ministry of Manpower, aggregated from Central Provident Fund board

The average (mean) monthly nominal earnings are around $4000 in 2010 (our estimate) per person $3,977 in 2008 and $3,872 in 2009 (Ministry of manpower). So an average house hold will have $8000 household income assuming a 2 person household.

So an average couple with $8000 income (with no current liabilities)

30 years housing loan tenor

50% debt servicing ratio

2% interest rates

The maximum affordability works out to be roughly $1.082m.

This means that the average Singapore household can afford a property of $1.35m. (If they can find the money for the downpayment) – A typical aggressive Singapore bank.

For a more conservative bank in Singapore, it may set the interest rate threshold at 3.75%, thereby reducing the loan size to $863,000 of loans.

This means that the average Singapore household can afford a property of $1.08m.

Since ministers and rich businessmen heavily skew the average salaries upwards, so the median salaries should be much lower. According to the Singstat, the median house hold income was $4,850 in 2009 (Singstat, http://www.singstat.gov.sg/news/news/op19022010.pdf ) and when median income was sorted by property type, house hold income of “$12,500 for private flats, condominiums and private houses in 2009” (Singstat, http://www.singstat.gov.sg/news/news/op19022010.pdf)

Singapore's Average household pay = $8000 (15 june 2010) – based on 2 x $4000 per person (2 to a household)

Singapore's Median Household pay = $4850 (based on 2009 figures)

So there is considerable income disparity in Singapore.

Since current private condominium owners have a household income of $12,500, so if we lower the entry barrier for private condominium purchase to $8,000, what will happen?

Assuming that the average household income at $8,000 who are not eligible for HDB “subsidized” property prices would like to upgrade to a condominium, these group of people if they have already an HDB would have a Cash-over-valuation amount which helps them to pay the downpayment. If these people are buying for the first time, they would be able to afford properties of between $1.08m to $1.35m at the maximum.

Based on an average small family nucleus of 2 person, such a family would stay in condominiums of around 800 to 1100 square feet. At $1m to $1.1m (using more conservative figures), this would represent an affordability level at $909 psf to $1,375 psf depending on the size of the unit purchased.

The likely property price effect is: -

HDB supply crunch leads to price increase in HDB.

HDB price increase leads (to some extent) to upgrading to mass market condominium (funded by HDB sales profits)

Direct purchase of condominiums skipping HDB altogether with an income level of $8,000 (per household), the affordability level can support property prices at $909 psf to $1,375 psf range (say 800 sq feet to 1100 sq feet).

Unfortunately, due to the fact that you can afford it, it will also be good reason for the Singapore government to raise prices of land and pass on the cost to the property developers who will then pass it on to you. Mass market singapore private properties may even possibly reach $1200 psf range, simply because you can afford it. (if employment holds stable and GDP is growing)

“ Among employed households, median household income from work was $1,090 for those in HDB 1- & 2-room flats, $3,190 for HDB 3-room flats, $5,560 for HDB 4-room or larger flats, and $12,500 for private flats, condominiums and private houses in 2009, lower when comparing with 2008.” (Singapore Department of Statistics Press Release, 19 Feb 2010)

In our previous research (Search for “Why HDB prices go Crazy” http://www.propertybuyer.com.sg/articles/singapore-property-investor-buyer/why-singapore-property-prices-go-crazy/) That craziness is due largely to lumpy supply and less than perfect timing by the Singapore government. This under-supply of properties lead to massive prices increase when sentiment is positive and affordability is achieved. This augurs well for the government coffers for land sales which help the government raise money so as to be able to run a budget surplus during this current 5 year term of PAP rule and hence able to give our election goodie bags.

However the Singapore government releases of more private land for building of condominiums creates more potential over-supply in the private residential market which needs to be absorbed by genuine property buyers.

Overall the risks for high end properties and mid to high end properties lies in it’s price volatility during market swings.

The risk in mass market condominiums lies in affordability and that of losing employment. At current elevated prices, if employment figures holds up, a new price benchmark is formed. Such new prices will likely hold firm. The mass market condominium is supported by HDB which is still currently in short supply. HDB forms the price basement for all mass market condominiums.

Note: Limitations in this assumption lies in it's looking only at loan serviceability and ignores cash downpayment portion. Using national savings as a guide would be misleading as the savings and cash holdings are not homogeneous across the country and not across all income groups. So for simplicity, we ignored the cash downpayment funding portion. However we do acknowledge that HDB profits can come up to $100,000 to $300,000 in some cases which can easily fund private properties 20% downpayment.

Some valuation and current prices (condos) in Shenton Way (ref: URA caveat): -

76 Shenton – between $1,900 - $2,400 psf.

The Sail @ Marina Bay - between $2,000 - $3,300 psf

International Plaza $1,100 range

Icon $1,600 - $1,700 psf

Some parts of China town, Tiong bahru, etc….

Leonie Hill, Leonie Studio $1,500 to $1,900

Grange residences $2,500 to $2,800 psf

Ardmore park $3,000 - $3,600 psf

Balmoral $1,500 - $1, 800 psf

Cyan Bukit timah (New development) $1,800 - $2,400 psf

Aspen heights $1,400 - $1,600 psf

Rivergate $1,600 to $1,900 psf

5th Avenue Condominium $1,200 to $1,400 psf

Singapore BANKS CREDIT stance

Banks have generally been more forth coming in their loans and loosened credit. Banks such as Citi banks which were burnt badly in the sub-prime crisis and was largely dormant has come to life with the introduction of an aggressive package SIBOR + 0.5% ascending to 0.9% in June 2010.

HSBC has also woke up from their slumber from around Feb 2010. And Bank of East Asia is starting to jump into the fray of residential housing loans.

Banks are starting to lend more freely.

Since banks are willing to lend more freely, we suggest you take more caution instead of letting your guard down. As property market comes in phases, do your own home work.

Effect of Global Market on Singapore property prices.

(Source: wikipedia, 2009, http://en.wikipedia.org/wiki/File:Nominal_GDP_IMF_2008_millions_of_USD.jpg )

Europe

A collective austerity measure by Europe may spell disaster for the world economy as it is the biggest economic bloc in the world. Although Europe can no longer spend more than they earn, but tightening at such a stage in the name of balancing the budget while noble is probably not the way to go about it. But neither is spending it’s way out of recession.

Spending cuts should be cut at segments that adds little job creation value. If UK and Germany cut public spending where private sector depended upon, this may further hurt private enterprise and shed more jobs. Europe may further look inwards and reduce trade with the rest of the world given this self imposed austerity drive.

Hopefully there are pockets of liquidity amongst the wealthy which certain policies can help bring such wealth into the path of consumption and thence job creation.

USA

After about 1 Trillion US dollar of stimulus, the economy seems to have stabled. And with that, it sends a stabilising signal to the rest of the world. However we are now reaching the tail end of the stimulus package which was first launched on Dec 2008 by President Obama. Economic recovery has been tentative at best. New fiscal stimulus may not be forthcoming given the massive budget deficit.

Many states are unable to balance their budget and depended to issuing municipal bonds to fund their deficits.

Source: http://www.tradingeconomics.com/Economics/Interest-Rate.aspx?Symbol=USD

The US has kept their Federal Reserve overnight interest rates at 0.25% for more than 1 year now. It is fairly certain to say that part of this cheap borrowing has benefited home owners and businesses, but part of it will certainly have flowed overseas as a “Carry Trade” activity where borrowers borrow at cheap rates and convert it to a higher yielding investment in another country. It is difficult to track how much of these funds are operating overseas.

It is also similarly difficult to estimate how much funds banks and other financial institutions have in order to lend out to help set the overnight benchmark interest rates as the federal reserve gradually winds down setting such a low interest rate as it's funds are gradually depleted. Without the Federal reserve's involvement, the benchmark interest rates will almost certainly rise.

CHINA

China is a growth engine and an export engine. And this economy is showing signs of increase in consumption. China has a massive surplus and foreign currency reserves estimated to be worth more than US$2 trillion dollars. The biggest in the world!

China funds the consumption by the united states as well as Europe. As long as China continue to fund the US and Europe, these governments can for the time being issue more bonds and hope that China and various cash rich sovereign funds buy their bonds so that they can continue to finance the deficit. Issuing bonds while at the same time creating extra money supply is not the best way, but it is still better than issuing more money supply without a corresponding debt or higher tangible asset value of the currency.

China's hot property market has become highly speculative. The rental yield of china's properties are very low, there is practically no rental value for many of these properties with sky high prices. Many are vacant. These is surely a bubble or what they would call, a musical chair, where one hopes to pass it on to the next person for a profit.

Assets that do not generate a yield are not assets, they are liabilities. We don't know when this situation will burst, but if and when it does, it could have ramifications across Asia. Chinese high net worth people who are burnt may start to unwind their investment holdings in the rest of Asia. This could be a potential and damaging negative economic headwind for Asia.

Singapore's Macro Economy

We are skeptical of the real strength of the Singapore economy. Despite the GDP's high growth, it is coming from a low base due to the prior recession and it is not entirely an efficiency led growth, but rather an immigration and investment led growth.

A demand led growth is more sustainable in our opinion. But that is not entirely within Singapore's government control.

Singapore per capital GDP would be pretty much the same, but as a result of massive immigration, the overall nominal GDP values will grow as expatriates and immigrants need housing, schools, food, services, etc.

Hence we expect that property prices will continue to ascent at a slow rate all the way towards end of 2010. And risks for property buyers will increase. However it is too early to guess when this property rally will end. If a property buyer is genuinely looking for somewhere to stay, they would still have to do so sensibly and quickly.

If a property investor is looking for investments, they may have missed the best part of the recovery story. If their time horizon is long, it would be prudent to wait a few years to time the market when the market is flooded with properties developed from Singapore's government massive land sales program now. But there is no guarantee that there will be a crash in the market as the Singapore government could always resort to bringing in even more foreigners to find demand for housing and therefore support high land prices.

SUMMARY (Assuming no massive fall-out from the global economy)

HDB – Prices to rise

Mass market – Prices to rise

Mid Tier – May rise

High End Luxury Market – Uncertain

Investment Opportunities In Such Uncertain Times

2 things struck me recently.

1) Most stock markets, e.g. S&P500, MSCI World etc have entered into a decline. It is a stage where I would never enter the markets. However, I've discovered certain markets that are still in stage 2, in an upward trendline. Some are cheap, some are not. I'll be calling some of you to discuss how to take advantage of these leading markets.

2) The JP Morgan Investment Grade Index is at 250bps. I assume the blended IG rating is around A, because investment grade ranges from AAA to BBB. In 2007, the thinnest spread seen was around 100bps or slightly less. Now if the US raises interest rates by 1.5 percentage points in 2011 and the Fed Funds end up at 2%, the yield curve could steepen even more as the tenor rises. The 5 year risk free could rise by 1.7% and 10 year could rise to 4.5% or 2%. The max an IG bond can tighten is by 1.5% so a 5 year IG bond could see rates rise by 0.2% and a 10 year IG bond could rise by 0.5%. A 5 year IG bond's price could fall by 1% and a 10 year fall by 5%.

But the High Yield Index (BB to C, average B) is at 740bps. The lowest was in 2007 at 300bps. There is room to tighten by around 340bps. A 5yr risk free rising by 1.7% could still see rates for High Yields fall by 1.7%. This could mean a capital appreciation of around 7 - 8%. 10yr risk free rising by 2% could still see a fall in HY rates by 140bps. A 10-y HY bond could appreciate by around 12 - 14%. The biggest upside seems to be in HY bonds/perps/convertible bonds now.

1) Most stock markets, e.g. S&P500, MSCI World etc have entered into a decline. It is a stage where I would never enter the markets. However, I've discovered certain markets that are still in stage 2, in an upward trendline. Some are cheap, some are not. I'll be calling some of you to discuss how to take advantage of these leading markets.

2) The JP Morgan Investment Grade Index is at 250bps. I assume the blended IG rating is around A, because investment grade ranges from AAA to BBB. In 2007, the thinnest spread seen was around 100bps or slightly less. Now if the US raises interest rates by 1.5 percentage points in 2011 and the Fed Funds end up at 2%, the yield curve could steepen even more as the tenor rises. The 5 year risk free could rise by 1.7% and 10 year could rise to 4.5% or 2%. The max an IG bond can tighten is by 1.5% so a 5 year IG bond could see rates rise by 0.2% and a 10 year IG bond could rise by 0.5%. A 5 year IG bond's price could fall by 1% and a 10 year fall by 5%.

But the High Yield Index (BB to C, average B) is at 740bps. The lowest was in 2007 at 300bps. There is room to tighten by around 340bps. A 5yr risk free rising by 1.7% could still see rates for High Yields fall by 1.7%. This could mean a capital appreciation of around 7 - 8%. 10yr risk free rising by 2% could still see a fall in HY rates by 140bps. A 10-y HY bond could appreciate by around 12 - 14%. The biggest upside seems to be in HY bonds/perps/convertible bonds now.

Sunday, 29 August 2010

Blackburn 1 Arsenal 2

At the start of the season, I thought that Arsenal's squad has improved by a little baby step because we added Chamakh, Koncielni and Squillachi. We kept our squad together by fending off the loud mouthed Barcelona team who seems to prefer to persuade Fabregas to join them via the press than to talk directly to the Arsenal. Without a new goalkeeper, Arsenal will probably fight for 3rd place with Man U. If we get a top class goalkeeper, we could reach 2nd or even win the League and maybe some minor tropy like the FA Cup.

Man U did not invest much in new players in the last 3 seasons because Glazer is still putting his hand in the cash till. Apparently, a BBC documentary investigated Glazer's financials and found out that they owned many shopping malls in the US that were not well occupied due to the Great Recession. Anyway, Man U seems weaker this season. Scholes, at 35, and Giggs at 37 are still in the first XI, which speaks a lot for Man U's finances. It is a team in decline and should end up 2nd or even 3rd.

Chelsea failed to make any major signing. They still haven't broken even in the 6th year of Abromovich's reign. Every season, they bled over GBP30m. Has the Russian oligarch grown tired of pumping money into his expensive toy? If he does, Chelsea will slip quickly down the slippery slope to bankruptcy just like Leeds. Their players are mostly past 30, but are still a formidable force with Italian efficiency. They are favourites for the title still, although decline seems inevitable.

Liverpool looks dead and buried by selling Mascherano. Unless a new owner with deep pockets takes over, Pool looks dead and buried. Standard Chartered Bank must be wondering why they spent millions sponsoring a club that probably can't get into the Champions League for the 2nd year in a row. 5th place if no sugar daddy arrives, but 4th if he/she does.

Manchester City could actually challenge for the league title. They have a good coach, a very strong squad and an owner who hasn't grown tired of his toy. Citeh could take 1st place, pushing Chelsea to 2nd, Man U 3rd and Arsenal 4th.

In this game, I noticed that Arsenal is stronger than last season. Their midfield holds the ball better, wins possession better too. They adopted a 4-2-3-1 formation when playing away, presumably to copy the great Spanish national team and Barcelona side. Diaby and especially Song did a good job protected the back 4. I felt Wenger needed 2 more players to make the team complete; a goalkeeper and another defensive midfielder. If Song is injured, I shudder to see Denilson back in the starting lineup. Our back 4 fell asleep after scoring the 1st goal. We were caught 3 against 3 in a counter. Sagna was out of position or slow to track back. Koncielni had to break formation to cover the marauding Diouf on our right. 2 Blackburn players in the middle waiting for the cross against 2 Arsenal defenders; Clichy and Vermaelen. Koncielni was beaten at the so Vermaelen broke formation to confront Diouf. It wasn't Vermaelen's fault. It was Clichy's fault for ball watching and not tracking his opponent coming from the blind side. It was classic defensive indiscipline that plagued Arsenal throughout Wenger's tenure. Luckily, we pulled one back from a rather fortuitous goal by Arshavin and nicked this.

Arshavin on the left, Fabregas in the middle and Walcott on the right provided the attacking thrust while van Pierse was the lone striker. I think we did ok going forward. Rosicky should have scored with only the goalkeeper to beat.

Blackburn isn't a top opponent. This season, whoever takes points off Chelsea, Man U, Citeh, Liverpool and Spurs will have a good chance of winning the league. If we defend like we did tonight, Arsenal fans will be disappointed for the 6th season yet again.

Man U did not invest much in new players in the last 3 seasons because Glazer is still putting his hand in the cash till. Apparently, a BBC documentary investigated Glazer's financials and found out that they owned many shopping malls in the US that were not well occupied due to the Great Recession. Anyway, Man U seems weaker this season. Scholes, at 35, and Giggs at 37 are still in the first XI, which speaks a lot for Man U's finances. It is a team in decline and should end up 2nd or even 3rd.

Chelsea failed to make any major signing. They still haven't broken even in the 6th year of Abromovich's reign. Every season, they bled over GBP30m. Has the Russian oligarch grown tired of pumping money into his expensive toy? If he does, Chelsea will slip quickly down the slippery slope to bankruptcy just like Leeds. Their players are mostly past 30, but are still a formidable force with Italian efficiency. They are favourites for the title still, although decline seems inevitable.

Liverpool looks dead and buried by selling Mascherano. Unless a new owner with deep pockets takes over, Pool looks dead and buried. Standard Chartered Bank must be wondering why they spent millions sponsoring a club that probably can't get into the Champions League for the 2nd year in a row. 5th place if no sugar daddy arrives, but 4th if he/she does.

Manchester City could actually challenge for the league title. They have a good coach, a very strong squad and an owner who hasn't grown tired of his toy. Citeh could take 1st place, pushing Chelsea to 2nd, Man U 3rd and Arsenal 4th.

In this game, I noticed that Arsenal is stronger than last season. Their midfield holds the ball better, wins possession better too. They adopted a 4-2-3-1 formation when playing away, presumably to copy the great Spanish national team and Barcelona side. Diaby and especially Song did a good job protected the back 4. I felt Wenger needed 2 more players to make the team complete; a goalkeeper and another defensive midfielder. If Song is injured, I shudder to see Denilson back in the starting lineup. Our back 4 fell asleep after scoring the 1st goal. We were caught 3 against 3 in a counter. Sagna was out of position or slow to track back. Koncielni had to break formation to cover the marauding Diouf on our right. 2 Blackburn players in the middle waiting for the cross against 2 Arsenal defenders; Clichy and Vermaelen. Koncielni was beaten at the so Vermaelen broke formation to confront Diouf. It wasn't Vermaelen's fault. It was Clichy's fault for ball watching and not tracking his opponent coming from the blind side. It was classic defensive indiscipline that plagued Arsenal throughout Wenger's tenure. Luckily, we pulled one back from a rather fortuitous goal by Arshavin and nicked this.

Arshavin on the left, Fabregas in the middle and Walcott on the right provided the attacking thrust while van Pierse was the lone striker. I think we did ok going forward. Rosicky should have scored with only the goalkeeper to beat.

Blackburn isn't a top opponent. This season, whoever takes points off Chelsea, Man U, Citeh, Liverpool and Spurs will have a good chance of winning the league. If we defend like we did tonight, Arsenal fans will be disappointed for the 6th season yet again.

Friday, 27 August 2010

Thinking of Buying Stocks? Think Again...

There are 4 stages in a stock market.

Stage 1 is when they are hovering at the bottom, after a major down trend. Case in point is Nov 08 - Mar 09. We should not buy during this period but to prepare to enter.

Stage 2: Break out from side ways trend. Often you either buy some on the first break out and then buy some more when it retraces back and stays above the previous resistance line. E.g. Apr 09.

Stage 3: Uptrend broken into a sideways trend. I would take 50% of my capital then. E.g. Apr 10.

Stage 4: Sideways trend is broken down. I would take the remaining 50% of my capital. E.g. Jun 10.

Guess where are most stock markets at now? Most of them are in Stage 3. Some have even entered Stage 4. Yet there is one market that is still at 2: Indonesia.

So don't itch to go into the market now. What goes down can go down lower. I don't think the correction will be deep. But it's better to be safe than sorry, isn't it?

Stage 1 is when they are hovering at the bottom, after a major down trend. Case in point is Nov 08 - Mar 09. We should not buy during this period but to prepare to enter.

Stage 2: Break out from side ways trend. Often you either buy some on the first break out and then buy some more when it retraces back and stays above the previous resistance line. E.g. Apr 09.

Stage 3: Uptrend broken into a sideways trend. I would take 50% of my capital then. E.g. Apr 10.

Stage 4: Sideways trend is broken down. I would take the remaining 50% of my capital. E.g. Jun 10.

Guess where are most stock markets at now? Most of them are in Stage 3. Some have even entered Stage 4. Yet there is one market that is still at 2: Indonesia.

So don't itch to go into the market now. What goes down can go down lower. I don't think the correction will be deep. But it's better to be safe than sorry, isn't it?

Tuesday, 24 August 2010

Another Month Long Correction Has Started?

Look at the AUDUSD, i.e. risk aversion currency. The stochastics has reached a dead cross again. Usually, when this happens stock markets worldwide undergo a correction of at least a month or even two.

Look at the MSCI World Index. It broken below the wedge. If you ask me how deep this correction is, I'd say it'll probably be only 10 - 20%, no more than that. The Non-Investment Grade Index is still sideways, LIBOR-OIS is falling.

Good thing that I got most of you out didn't I? Now you should try the Amundi World Volatility Fund or short stocks.

Look at the MSCI World Index. It broken below the wedge. If you ask me how deep this correction is, I'd say it'll probably be only 10 - 20%, no more than that. The Non-Investment Grade Index is still sideways, LIBOR-OIS is falling.

Good thing that I got most of you out didn't I? Now you should try the Amundi World Volatility Fund or short stocks.

Monday, 23 August 2010

Rough Week Ahead for Equities

Economic data in the US is pointing towards a double-dip. Initial unemployment claims rose to 500,000 last week, a level usually associated with a recession. My bet is the Obama administration will step in. Many things could still go wrong even with a stimulus 2.0; deleveraging by consumers of the western world is one big problem. Perhaps a bigger problem is the persistently high energy costs. Oil continues to hover between USD70 - 85 / bbl even when demand is sluggish. It suggests that Peak Oil has already passed.

Even if the western world escapes from a double dip in 2011, they will struggle with stagflation that year. The rest of the world, especially commodity exporting countries like Russia, Australia, Canada, Brazil, Middle East, rest of Latin America and Africa should slowly emerge as the strongest economies. I'm not too sure about other commodity importing, large economies like China and India. Their economies will grow at between the western world's 1 - 2% and commodity world's 5 - 8%. China and India will probably be grapplying with inflation too, although their growth is much better than the western world's.

Then there's the pension funds in the western world starting to redeem their funds to pay for the baby boomers' pension liabilities. There will be a lot of selling between now and 2012.

Equities don't rise very much during periods of stagflation. I believe only the commodity countries and BRIIC will experience any upside in equities.

Meanwhile, the short term outlook is negative for the next 1 - 3 months. I don't expect equities to fall by more than 20%. The Credit Spreads are surprisingly holding steady. If stocks in MSCI Asia ex Japan falls by more than 10%, I'll start to buy again.

I like the commodity sector. M&A will drive stock prices in the next few years.Mining companies find it safer and cheaper to acquire small competitors instead of the more risky exploration business. Oil rig manufacturers will find a booming biz. The Asia consumer story is also very real. Companies in gaming, retail, fashion and food will do very well. Tech companies that rely on consumer spending should do well. Corporate spending on tech will be very niche. I'm not too bullish on property stocks because I don't think home prices will rise next year over Asia. Office and retail properties may triumph. The automotive sector with exposure to Asia ex Japan should fly through the roof.

Even if the western world escapes from a double dip in 2011, they will struggle with stagflation that year. The rest of the world, especially commodity exporting countries like Russia, Australia, Canada, Brazil, Middle East, rest of Latin America and Africa should slowly emerge as the strongest economies. I'm not too sure about other commodity importing, large economies like China and India. Their economies will grow at between the western world's 1 - 2% and commodity world's 5 - 8%. China and India will probably be grapplying with inflation too, although their growth is much better than the western world's.

Then there's the pension funds in the western world starting to redeem their funds to pay for the baby boomers' pension liabilities. There will be a lot of selling between now and 2012.

Equities don't rise very much during periods of stagflation. I believe only the commodity countries and BRIIC will experience any upside in equities.

Meanwhile, the short term outlook is negative for the next 1 - 3 months. I don't expect equities to fall by more than 20%. The Credit Spreads are surprisingly holding steady. If stocks in MSCI Asia ex Japan falls by more than 10%, I'll start to buy again.

I like the commodity sector. M&A will drive stock prices in the next few years.Mining companies find it safer and cheaper to acquire small competitors instead of the more risky exploration business. Oil rig manufacturers will find a booming biz. The Asia consumer story is also very real. Companies in gaming, retail, fashion and food will do very well. Tech companies that rely on consumer spending should do well. Corporate spending on tech will be very niche. I'm not too bullish on property stocks because I don't think home prices will rise next year over Asia. Office and retail properties may triumph. The automotive sector with exposure to Asia ex Japan should fly through the roof.

Sunday, 22 August 2010

Arsenal 6 Blackpool 0: Big Win Fails to Unmask Weaknesses

We won 6-0. It was a great game. But we played against a very weak opponent who did not buy new players when they were promoted to the Premiership this season.

There were some moments when I felt we could have performed better defensively. Gael Clichy was ball watching and allowed a Blackpool player to jump above him to head the ball. Luckily it was out wide.

If you think that I'm overly critical, compare our performance last week against Liverpool and last night against Blackpool. At Anfield, we were pathetic, gaining more posession without any real thrust. We were lucky to scrap a draw. Liverpool were full-blooded, cynical professionals who didn't allow us to play. Physically, they were very rough because they knew they'd unsettle our lads. They knew that if they press hard our small-framed central defenders may lose their shape. Vermalen was turned by Ngog and scored. Blackpool allowed us too much space. They didn't foul to disrupt our rythm. They were our perfect opponent.

We are about 8 to 9 days away from the closing of the transfer window and Wenger still failed to buy a new goalkeeper. In the last World Cup, Spain won because they have one of the best shot stopper in the world. When their impregnable defence failed, Iker Casillas made a vital save. Minutes later Spain scored against Holland.

Wenger is partial to his favourite players. The whole world could see for the last 5 years that Almunia was not good enough, except Wenger. Now that we have 2 potential replacements available; Shay Given and Mark Shwarzer, when the gaffer is dragging his feet to buy either. It's incredible how we trust his judgements when we've won nothing for the last 5 years.

There were some moments when I felt we could have performed better defensively. Gael Clichy was ball watching and allowed a Blackpool player to jump above him to head the ball. Luckily it was out wide.

If you think that I'm overly critical, compare our performance last week against Liverpool and last night against Blackpool. At Anfield, we were pathetic, gaining more posession without any real thrust. We were lucky to scrap a draw. Liverpool were full-blooded, cynical professionals who didn't allow us to play. Physically, they were very rough because they knew they'd unsettle our lads. They knew that if they press hard our small-framed central defenders may lose their shape. Vermalen was turned by Ngog and scored. Blackpool allowed us too much space. They didn't foul to disrupt our rythm. They were our perfect opponent.

We are about 8 to 9 days away from the closing of the transfer window and Wenger still failed to buy a new goalkeeper. In the last World Cup, Spain won because they have one of the best shot stopper in the world. When their impregnable defence failed, Iker Casillas made a vital save. Minutes later Spain scored against Holland.

Wenger is partial to his favourite players. The whole world could see for the last 5 years that Almunia was not good enough, except Wenger. Now that we have 2 potential replacements available; Shay Given and Mark Shwarzer, when the gaffer is dragging his feet to buy either. It's incredible how we trust his judgements when we've won nothing for the last 5 years.

Saturday, 21 August 2010

Equity Outlook & Bond Bubble

Equity markets have turned negative again. This time, the signal is negative for the next week, probably (I say "probably" because the signal has not be confirmed, but appears to be about to) negative for the next one to two months, but over six months, positive. The correction is not likely to be large, as far as I can see from the JP Morgan Non Investment Grade Index. I use the triple screen theory to tell me where equity markets are headed. We should see markets heading down further in Sep 2010 to the tune of 10 - 20% before rebounding and hopefully breaking new highs.

I'm not very hopefully of US stocks in general. The western economy is in shambles. Their new normal is a deleveraged world where governments are spending far less, consumers more cautious, and energy costs pushing up inflation.

To some clients, investing is only about equities. They ignore that most of the liquidity went into bonds, preferred shares and convertible bonds. There were several issues that had fantastic yields at IPO. Upon trading, they shot up by 4 to 5%.

I'm not very hopefully of US stocks in general. The western economy is in shambles. Their new normal is a deleveraged world where governments are spending far less, consumers more cautious, and energy costs pushing up inflation.

To some clients, investing is only about equities. They ignore that most of the liquidity went into bonds, preferred shares and convertible bonds. There were several issues that had fantastic yields at IPO. Upon trading, they shot up by 4 to 5%.

Monday, 16 August 2010

A Key Milestone Has Been Crossed in My Life

It's very private. I've been struggling to achieve something for a long time. It's embarrassing that I haven't achieved it much earlier. But I've achieved it now. It affects my career, my direction, my self esteem. I made a decision earlier this year to change my tactic, my methods, to see if it would work. I don't know if I can attribute my humble victory to this change of tactic. But it certainly coincided with this victory. My title has changed from now on. Nothing can take it away from me. My mom used to say, "money you can lose, but what you learned cannot be stolen from you."

Thank you God for listening to my trivial prayers. I must say it took a long time to be answered but perhaps You were testing me, building my perseverance and humility. The trial and long wait has made me a better person. Next to God, I owe the most to my lovely wife for putting up with my nonsense and obsessive quest for my endeavour, and to all my close friend for supporting me through this period. Love you all.

Thank you God for listening to my trivial prayers. I must say it took a long time to be answered but perhaps You were testing me, building my perseverance and humility. The trial and long wait has made me a better person. Next to God, I owe the most to my lovely wife for putting up with my nonsense and obsessive quest for my endeavour, and to all my close friend for supporting me through this period. Love you all.

Liverpool 1 Arsenal 1

Arsenal was very lucky to equalise via a rare error by Peppe Reina. It was the same old Arsenal, lots of passing without penetration, soft at the back. The central defence does not have enough cover because they lost 4 players and bought only 1. Even the one player that was bought was not strong nor tall in stature.

There were no strengthening of the central defence to protect the 4 gnomes at the back. Our goalkeeper is still as butterfingers. I don't care if Almunia makes several good saves in this game. He missed clearing a corner kick and that didn't instill confidence at the back.

Loyal fans of Arsenal can defend Wenger to the death, saying that he achieved Champions League football on a shoestring budget. But our shift to the Emirates is over. We have paid back the bulk of our long-term debt. What are we saving our bullets for?

This season should end without a trophy for Arsenal again. It's a sad ending that's likely to happen.

There were no strengthening of the central defence to protect the 4 gnomes at the back. Our goalkeeper is still as butterfingers. I don't care if Almunia makes several good saves in this game. He missed clearing a corner kick and that didn't instill confidence at the back.

Loyal fans of Arsenal can defend Wenger to the death, saying that he achieved Champions League football on a shoestring budget. But our shift to the Emirates is over. We have paid back the bulk of our long-term debt. What are we saving our bullets for?

This season should end without a trophy for Arsenal again. It's a sad ending that's likely to happen.

Sunday, 15 August 2010

What Makes a Stock Price Fly?

Hewlett Packard, BP PLC, Zijin Mining, Fraser & Neave, Ho Bee Investments, IG Group, Rolls Royce, Citigroup... The list goes on. Every day, I receive a list of stocks that could potentially break up, from a computer program that I wrote. Out of a list of say 10 stocks, 2 to 3 eventually went on to achieve 300% return in several months. I bought Data Dimenions, a South African system integrator with a listed subsidiary called Datacraft that was taken private. Data Dimension was recently taken private at a 30% premium to the last traded price. Nice profit. But I've had many misses to. Take local education centre Informatics. It was trading at 6 cts for several months. My program signalled a buy 2 days before it broke up to 18.5 cts. I cannot possibly buy every stock that is signalled a buy because I would end up with a thousand stocks in my portfolio!

If I filter my program a little stricter, another type of error occurs where all the stocks that are 10x baggers are filtered out. I have to find the "right" filter to administer so as not to omit the important stocks.

That's just for technicals. What about fundamentals? What makes a stock more attractive than another? Is it the potential for M&A? If a stock trades too cheap, its own management may try to take it private or another company may find it attractive to take over. This will cause the stock price to rise to its "fair value". What about its earnings? It matters if you own more than 50% of the company because you will then control the cashflow. But if you're minority shareholder, you will never get a cent of the earnings. It's therefore the dividend that you should be interested in.

There is also a liquidation value of a company. During the last crisis, many stocks with perfectly good fundamentals traded below its liquidation value. That should be a very good indication of value too.

If I filter my program a little stricter, another type of error occurs where all the stocks that are 10x baggers are filtered out. I have to find the "right" filter to administer so as not to omit the important stocks.

That's just for technicals. What about fundamentals? What makes a stock more attractive than another? Is it the potential for M&A? If a stock trades too cheap, its own management may try to take it private or another company may find it attractive to take over. This will cause the stock price to rise to its "fair value". What about its earnings? It matters if you own more than 50% of the company because you will then control the cashflow. But if you're minority shareholder, you will never get a cent of the earnings. It's therefore the dividend that you should be interested in.

There is also a liquidation value of a company. During the last crisis, many stocks with perfectly good fundamentals traded below its liquidation value. That should be a very good indication of value too.

Friday, 13 August 2010

What to Make of This Week's Sell Down

Investing in equities is like living near a volcano. The carbon-rich soil is fertile, suitable for growing crops. When the volcano is dormant, all is good, the farmer gets abundant harvest, lifestocks expand bountifully. Once in a while smoke erupts from the volcano. Sometimes the ground trembles. These moments cause the farmer to worry whether this is the BIG eruption that will wipe out not only his wealth, but his family as well. If the farmer is extremely cautious and shifts his home everytime the volcano blows smoke, it will be very disruptive to his family and he may end up bankrupt because other lands may have less fertile soil. If he lives "too near the edge", i.e. ignore the warnings too often, or only pays attention to the more extreme tremours, he may leave it too late to save himself.

Investing is like that. You can buy-and-hold, ride out the peaks and troughs, earning that 15 - 20% per annum, but experiencing volatility of being 100% up in a bull year and -70% down in a bear year. You can try to trade more often and exit at the slightest sign of distress, which means that you will probably avoid the volatility of -70% down. But you also miss out on the upside as well. Plus your trading costs will skyrocket. The 3rd way is to trade less, maintain a balance across asset classes and exit equities only on the major bears.

For those who use methods 2 and 3, you'll be concerned whenever we face violent corrections such as the one we experienced this week. Stock markets worldwide fell by around 4 - 6% this week. You'll probably wonder if this is the BIG one; the one that will wipe out your family.

My take is that this is a mild one. There are many indicators suggesting this. Non Investment Grade index has not shot up. 3mth LIBOR - OIS spread is falling. Only the VIX is up to 25. Valuations are still below average, at around 14x. 10y bond yields are still at record low levels. Earnings yield premium is around 4 - 5%. 4 out of 5 ain't bad.

But we should be close to another major correction. I've spoken to some of you to take profit already. Sell in stages, take profit if you have, maintain an asset allocation of around 60 - 70% equities.

I will write more to explain my position later.

Investing is like that. You can buy-and-hold, ride out the peaks and troughs, earning that 15 - 20% per annum, but experiencing volatility of being 100% up in a bull year and -70% down in a bear year. You can try to trade more often and exit at the slightest sign of distress, which means that you will probably avoid the volatility of -70% down. But you also miss out on the upside as well. Plus your trading costs will skyrocket. The 3rd way is to trade less, maintain a balance across asset classes and exit equities only on the major bears.

For those who use methods 2 and 3, you'll be concerned whenever we face violent corrections such as the one we experienced this week. Stock markets worldwide fell by around 4 - 6% this week. You'll probably wonder if this is the BIG one; the one that will wipe out your family.

My take is that this is a mild one. There are many indicators suggesting this. Non Investment Grade index has not shot up. 3mth LIBOR - OIS spread is falling. Only the VIX is up to 25. Valuations are still below average, at around 14x. 10y bond yields are still at record low levels. Earnings yield premium is around 4 - 5%. 4 out of 5 ain't bad.

But we should be close to another major correction. I've spoken to some of you to take profit already. Sell in stages, take profit if you have, maintain an asset allocation of around 60 - 70% equities.

I will write more to explain my position later.

Sunday, 8 August 2010

Funds That Perform Well When Stocks Don't

My next post will discuss about why you should hold on to good unit trusts, unless you can find a stock that can outperform the unit trusts. Unit trusts are useful because of the following reasons:

1. Diversification in the fastest moving markets, e.g. Brazil, which shot up by 8X between 2002 - 2007! You can't get that by investing in most blue chip stocks in Singapore!

2. Safer way to achieve capital gains without fear of bankruptcy. With stocks, you worry about whether the company will go bust. But unit trusts are diversified among more than 50 stocks so there is little worry of losing everything.

3. Funds that are well managed can outperform their benchmarks. Often, investors tout ETFs as better investment tools than unit trusts. But there are examples of funds that outperform ETFs: Templeton Asian Growth outperforms consistently the MSCI Asia ex Japan. Aberdeen Global Emerging Market outperforms the MSCI Emerging Market for the last 5 years.

4. ETFs have counter party risks. E.g. if Barclays, which manages iShares, goes bust, so does your ETF. But the assets within unit trusts belong to investors. The fund manager may go bust, but the underlying stocks belong to investors. The trustee ensures that the assets are ring-fenced against any financial loss of the fund manager.

Preferreds Still Offer Above-Average Yields

Published August 7, 2010

Real estate preferreds rebound; they still offer above-average yields

(New York)

HUGE RETURNS

Preferreds are an area in which investors get paid well for the risks they take, says Mr Beam. His fund returned 46 per cent in the past one year.

JOEL Beam stood out as an undergraduate at the University of California, Berkeley in the early 1990s. On a campus where jeans and T-shirts predominated, he was the one often wearing the coat and tie.

Back then, Mr Beam was a humanities major who also had an interest in real estate. As a freshman, he'd worked part time as a clerk for a local real estate developer. Then, as a sophomore, he landed an internship at Liquidity Fund Investment Corp, an investment firm specialising in distressed real estate securities.

'I remember going into the college placement office and seeing that ad and thinking this was the best internship I had ever heard of,' Mr Beam, 39, says. 'It was basically like a full-time, entry-level analyst job.'

Focus on real estate

The gig had Mr Beam rushing from school to work, Bloomberg Markets reports in its September issue. He would attend classes on rhetoric dressed in business attire so he could hop on the bus afterwards and get to his job in nearby Emeryville, where Mr Beam appraised properties and related securities. He ended up taking a fifth year to complete his course requirements at Berkeley, and after earning a degree with honours in 1994, he joined Liquidity Fund full time.

Nowadays, Mr Beam still focuses on real estate, aiming to generate income and steady returns by investing in high-yielding securities of property companies as the manager of the US$1 billion Forward Select Income Fund.

Mr Beam buys mostly preferred shares. 'It's a smaller sector of the market, and there's a really nice opportunity that we've had good success at exploiting,' says Mr Beam, who left Liquidity Fund in 1995 to join former colleagues after they started their own firm, Kensington Investment Group Inc. San Francisco-based Forward Management LLC acquired Kensington in June 2009.

Mr Beam says that preferreds are an area in which investors get paid well for the risks they take. 'So we've been able to earn pretty good returns,' he says.

The Forward Select Income Fund returned 46 per cent in the 12 months ended on Aug 4, beating 93 per cent of its peers. Buffeted by the US real estate and financial market meltdown that began in 2007, the fund gained 0.49 per cent annually during the five years ended on Aug 4; in 2009, it surged 75 per cent, according to data compiled by Bloomberg.

Preferred shares combine elements of stock and debt. Like common shares, they offer the potential for appreciation, while, similar to bonds, their fixed dividends provide regular income. Mr Beam's fund pays a quarterly dividend out of the income it derives from its preferred holdings. As at Aug 5, the fund's 12-month dividend yield was 9.45 per cent, Bloomberg data shows.

While preferred shares rank higher in a company's capital structure than common stock - meaning they have a higher priority in terms of dividend payments and in case of liquidation - they often carry no voting rights and are subordinate to a company's bonds. The universe of preferred stock is also smaller than that of common shares and bonds, and preferreds don't trade as frequently.

Preferreds issued by real estate investment trusts, or Reits, are a special case, Mr Beam says, because Reits are required to distribute 90 per cent of their income to investors. 'If they plan to stay in business and survive as a Reit, they've got to pay those dividends,' he says.

Steady earnings

Among Mr Beam's biggest holdings as at April 30 were preferred shares of Westlake Village, California-based nursing home operator LTC Properties Inc and San Clemente, California-based Sunstone Hotel Investors Inc.

Mr Beam counts LTC among his favourite holdings, given the company's steady earnings and stable business.

'I have owned this preferred for years, and it is pretty dull, but they just plug away,' Mr Beam says. 'The company has very low leverage. Their rhetoric is excellent in terms of their desire to honour their preferred and treat it like debt, which is how we look at it. I just love it.'

The real estate preferred market wasn't immune to the bust that originated in US housing and went on to roil world markets. At Kensington, the value of the Select Income Fund's assets under management tumbled to US$293 million in early 2009 from almost US$800 million in mid-2007 as securities slumped during the credit crisis, Mr Beam says. 'Prices were just sinking every day, and there was no bid for a lot of paper,' he says.

Investors value preferred securities the same way they do bonds, with a higher dividend yield implying a cheaper price.

'Our market was all over the place, and so we had an opportunity to rearrange the portfolio and buy paper that was trading at levels that we thought we would never see,' Mr Beam says.

Purchases included preferred shares of Indianapolis-based Duke Realty Corp, Denver-based ProLogis and Bloomfield Hills, Michigan-based Taubman Centers Inc. 'These were fallen-angel companies in a lot of ways, and they were basically being priced for worse than default,' he says.

The Duke preferreds, for instance, traded as low as US$6 for a yield of more than 30 per cent in early 2009. They traded at US$26.67 on Aug 5.

While real estate preferreds have rebounded, they still offer above-average yields, Mr Beam says. As at mid-July, real estate preferreds yielded about 500 basis points more than 10-year Treasuries, above their average of 365 basis points during the 10 years before the financial crisis, he says. 'These are times that we actually start to get excited,' Mr Beam says. 'We always love the product, but when it gets cheap and we know that the credit is sound, we get very excited.' -- Bloomberg

Real estate preferreds rebound; they still offer above-average yields

(New York)

HUGE RETURNS

Preferreds are an area in which investors get paid well for the risks they take, says Mr Beam. His fund returned 46 per cent in the past one year.

JOEL Beam stood out as an undergraduate at the University of California, Berkeley in the early 1990s. On a campus where jeans and T-shirts predominated, he was the one often wearing the coat and tie.

Back then, Mr Beam was a humanities major who also had an interest in real estate. As a freshman, he'd worked part time as a clerk for a local real estate developer. Then, as a sophomore, he landed an internship at Liquidity Fund Investment Corp, an investment firm specialising in distressed real estate securities.

'I remember going into the college placement office and seeing that ad and thinking this was the best internship I had ever heard of,' Mr Beam, 39, says. 'It was basically like a full-time, entry-level analyst job.'

Focus on real estate

The gig had Mr Beam rushing from school to work, Bloomberg Markets reports in its September issue. He would attend classes on rhetoric dressed in business attire so he could hop on the bus afterwards and get to his job in nearby Emeryville, where Mr Beam appraised properties and related securities. He ended up taking a fifth year to complete his course requirements at Berkeley, and after earning a degree with honours in 1994, he joined Liquidity Fund full time.

Nowadays, Mr Beam still focuses on real estate, aiming to generate income and steady returns by investing in high-yielding securities of property companies as the manager of the US$1 billion Forward Select Income Fund.

Mr Beam buys mostly preferred shares. 'It's a smaller sector of the market, and there's a really nice opportunity that we've had good success at exploiting,' says Mr Beam, who left Liquidity Fund in 1995 to join former colleagues after they started their own firm, Kensington Investment Group Inc. San Francisco-based Forward Management LLC acquired Kensington in June 2009.

Mr Beam says that preferreds are an area in which investors get paid well for the risks they take. 'So we've been able to earn pretty good returns,' he says.

The Forward Select Income Fund returned 46 per cent in the 12 months ended on Aug 4, beating 93 per cent of its peers. Buffeted by the US real estate and financial market meltdown that began in 2007, the fund gained 0.49 per cent annually during the five years ended on Aug 4; in 2009, it surged 75 per cent, according to data compiled by Bloomberg.

Preferred shares combine elements of stock and debt. Like common shares, they offer the potential for appreciation, while, similar to bonds, their fixed dividends provide regular income. Mr Beam's fund pays a quarterly dividend out of the income it derives from its preferred holdings. As at Aug 5, the fund's 12-month dividend yield was 9.45 per cent, Bloomberg data shows.

While preferred shares rank higher in a company's capital structure than common stock - meaning they have a higher priority in terms of dividend payments and in case of liquidation - they often carry no voting rights and are subordinate to a company's bonds. The universe of preferred stock is also smaller than that of common shares and bonds, and preferreds don't trade as frequently.

Preferreds issued by real estate investment trusts, or Reits, are a special case, Mr Beam says, because Reits are required to distribute 90 per cent of their income to investors. 'If they plan to stay in business and survive as a Reit, they've got to pay those dividends,' he says.

Steady earnings

Among Mr Beam's biggest holdings as at April 30 were preferred shares of Westlake Village, California-based nursing home operator LTC Properties Inc and San Clemente, California-based Sunstone Hotel Investors Inc.

Mr Beam counts LTC among his favourite holdings, given the company's steady earnings and stable business.

'I have owned this preferred for years, and it is pretty dull, but they just plug away,' Mr Beam says. 'The company has very low leverage. Their rhetoric is excellent in terms of their desire to honour their preferred and treat it like debt, which is how we look at it. I just love it.'

The real estate preferred market wasn't immune to the bust that originated in US housing and went on to roil world markets. At Kensington, the value of the Select Income Fund's assets under management tumbled to US$293 million in early 2009 from almost US$800 million in mid-2007 as securities slumped during the credit crisis, Mr Beam says. 'Prices were just sinking every day, and there was no bid for a lot of paper,' he says.

Investors value preferred securities the same way they do bonds, with a higher dividend yield implying a cheaper price.

'Our market was all over the place, and so we had an opportunity to rearrange the portfolio and buy paper that was trading at levels that we thought we would never see,' Mr Beam says.

Purchases included preferred shares of Indianapolis-based Duke Realty Corp, Denver-based ProLogis and Bloomfield Hills, Michigan-based Taubman Centers Inc. 'These were fallen-angel companies in a lot of ways, and they were basically being priced for worse than default,' he says.

The Duke preferreds, for instance, traded as low as US$6 for a yield of more than 30 per cent in early 2009. They traded at US$26.67 on Aug 5.

While real estate preferreds have rebounded, they still offer above-average yields, Mr Beam says. As at mid-July, real estate preferreds yielded about 500 basis points more than 10-year Treasuries, above their average of 365 basis points during the 10 years before the financial crisis, he says. 'These are times that we actually start to get excited,' Mr Beam says. 'We always love the product, but when it gets cheap and we know that the credit is sound, we get very excited.' -- Bloomberg

Monday, 2 August 2010

To Buy Or Not To Buy... That's the Question

I found a property in Singapore. It's got everything that I want. It's got a rental yield that's unheard of, that will easily cover my mortgage plus give me some income. Even if S'pore's Swap Offer Rate rises to 3.5% in 2012, my yield will still cover my interest + some of my principle. It's strategically located near a place that will be redeveloped into something huge. It's a rare find.

My worry, a big one at that, is what if the economy goes into a double dip? Will I have ammunition left to buy more properties when everything is cheaper? Will the value of my properties drop so much that the banks ask me to top up? Could I have timed my purchase better? More importantly, will my property continue to rise due to the catalysts? I recalled Chiltern Park bucking the trend and rising even during the financial crisis. Is this another "Chiltern Park"?

We are at mid cycle. I am more bearish on properties than on stocks because properties have an element of supply overhang from 2011 onwards. I can see mickey mouse units' prices tumble. Seriously, who the hell wants to live in a rabbit hole 500 - 700 square feet? It's just a developer's gimmick to buy land bank through en bloc and then increase the average selling price through smaller units. When all these studios are finally being completed in 2011 to 2012, the shit hits the fan because the owners will find no tenants.

Always return to the fundamentals. 2-bedroom and 3-bedroom units are the best buys because it caters for single expats, newly married couples and small families. There are 3.9 people to a household in Singapore so on average 3 bedrooms are just nice. I tried living in a studio once. It's impossible.

If I buy now, the economy must avoid a double dip and my new place must gain interest. I believe it will.

My worry, a big one at that, is what if the economy goes into a double dip? Will I have ammunition left to buy more properties when everything is cheaper? Will the value of my properties drop so much that the banks ask me to top up? Could I have timed my purchase better? More importantly, will my property continue to rise due to the catalysts? I recalled Chiltern Park bucking the trend and rising even during the financial crisis. Is this another "Chiltern Park"?

We are at mid cycle. I am more bearish on properties than on stocks because properties have an element of supply overhang from 2011 onwards. I can see mickey mouse units' prices tumble. Seriously, who the hell wants to live in a rabbit hole 500 - 700 square feet? It's just a developer's gimmick to buy land bank through en bloc and then increase the average selling price through smaller units. When all these studios are finally being completed in 2011 to 2012, the shit hits the fan because the owners will find no tenants.

Always return to the fundamentals. 2-bedroom and 3-bedroom units are the best buys because it caters for single expats, newly married couples and small families. There are 3.9 people to a household in Singapore so on average 3 bedrooms are just nice. I tried living in a studio once. It's impossible.

If I buy now, the economy must avoid a double dip and my new place must gain interest. I believe it will.

Sunday, 1 August 2010

Investment Outlook 2nd Half 2010 - 2011

I have this uneasiness about our long-term future. We are addicted to hydrocarbons, warming up the earth at an exponential rate. Northern countries like Russia are experiencing record high temperatures this summer. We are probably past the peak of oil reserves. No more easy oil. We are drilling deeper into the ocean, resorting to more difficult to process oil sands.Yet the demand is accelerating because China, India and the rest of the emerging world are still at their early stages of economic development, with the same living standards that the Europeans were back in the 1950s. But the population of the emerging world is far larger, at 5 billion vs less than 500 million Europeans and Americans in the 1950s. The world will surely either run out of cheap oil or boil to death in the next 20 - 30 years. Yes, it will happen in most of our lifetime.

Food demand is rising faster than our productivity gains can cope. Forests, which absorb carbon dioxide and produce oxygen, are being stripped to grow crops. Carbon intensive animal farming is increased to meet the demand for more protein.

Wars will be fought over fresh water. If the glaciers disappear, perhaps 30 - 50% of the world's water supply will dry up.

That's all very depressing. Now back to the relatively more cheerful near term!

The Economy

We are not likely to hit a double-dip in 2011. We may have a recession in end 2011 or 2012, which is more than a year away. But not now. Look at the chart above. Our 10-yr US Treasury is around 3% while the 3mth US Treasury is around 0.5%. When short term yields are so low, the economy is unlikely to fall into a recession in the next 12 months.

When will our short term yields start to rise? It all depends on inflation. In the US, inflation is between 1.5 - 2.5%. With economic growth anaemic for 2H 2010, I don't expect inflation to rise until 1H 2011 when the world's economies stop its decline and start to rise. Inflation will quickly hit 2.5 - 3.5% by middle of 2011, forcing the US and EU into a series of hikes that will bring the Fed Funds to 2.5%, which is the considered the "mid point" by most economists. The hikes will continue until the end of 2011, when it may reach 3.5 to 4%. However, since the 10 year UST hovers around 3 to 3.5%, inversion of yield curve may occur as early as 3Q 2011. Then the clock starts ticking. By 3Q2012, we are likely to have another recession.

All this while, the US and EU will not enjoy the kind of GDP growth seen between 2004 - 2007. Those years were fuelled by drunken leverage. NObody needed to save or put downpayments to buy houses. This time round, households in the developed world are deleveraging. Wages will rise very slowly while unemployment will fall very slowly. Economic growth will range between 2 - 3% in the US and 1 - 2% in the EU. The rest of the world will spend more but will fail to fill the gap left by the developed world.

Inflation will run riot before growth in the US and EU can hit anywhere near 3 - 4%. Why? Back in 2005, oil prices were still benign at between USD20 - 50 bbl. It took 2 years for high oil prices to filter into higher inflation. Oil price hit USD70bbl in 2009; 2 years later, we will face spiralling inflation.

In Asia and the rest of Emerging Markets, we will see 5 - 8% GDP growth but inflation between 3 - 6% in most countries. Rate hikes, which already began early 2010, will continue into 2011.

Welcome to the age of STAGFLATION! The vocab most governments want to shun.

Equity Outlook

So if we are not facing a double dip in 2011, but we will face a recession in 3Q 2012, what will happen to equity markets? Equities are likely to rise after 6 months of consolidation. The consolidation in most markets started in April 2010 and I don't expect it to last beyond Oct 2010. Investors, who are doubtful of stock markets and parked most of their money into bonds, will be surprised at the strength of the rally at the end of the year. They will also see their bond returns destroyed by inflation and belatedly shift their funds back into equities. Such is the POWER OF ZERO. When rates are this low, it is impossible to remain in cash for long. It has to go somewhere.

The rally may last until end 2011 or early 2012 (before 1Q2012). We will probably Emerging stock markets hitting new highs. Markets like Mongolia will be headline news for their staggering rallies.

Look at the LIBOR-OIS spread above. It is finally thawing. Banks are less nervous and will lend more henceforth. Get ready for another rally. Stay in Asia ex Japan and Emerging Markets. I like stocks in Brazil, Russia and India. For regions, I like the Middle East, Eastern Europe, resource rich regions like Latin America and Africa. I would avoid developed markets at all costs. High correlation of stock markets worldwide mean there is little diversification benefit in the first place. So why buy US?

Caveat: We may see stock markets falling another 10 - 20%, triggering a mini-bear market, shaking out all the investors with no holding power before rallying. In the mean time, stay neutral (60% equities max).

Bonds

We are entering an age of high inflation. Yields will never be this low again. Inflation will destroy the value of investment grade bonds. Avoid investment grade bonds like AAA, AA or A. I would focus on emerging market government and corporate debt. Yields can still come down, though not by much. If stocks were to crash, bonds usually rise. But this time, I am doubtful that bonds can provide the shelter because interest rates in developed countries are already at record low. Only in Emerging Markets and in commodity rich countries like Canada, Australia and Brazil have started to hike rates and have monetary room to ease.

Be very careful therefore. Go for fixed income of Asian coutnries and corporates where fundamentals are better.

Commodities

A super cycle that is likely to rise higher in 2011. The world must rid itself of oil addiction. Otherwise, we might never enjoy another period of high growh, low inflation again. Technology must resolve the world's resource constraints otherwise the future is bleak. For these reasons, commodities are the way to go.